Summary:

- Ideal for automated trading

- Variable fee for shares and fixed fee for derivatives

- Broker regulated both in the USA and in Europe

- Ability to use both IBKR and TS platforms

![]() Pros:

Pros:

- One of the largest range of products and markets available

- Possibility to connect both TradeStation and Interactive Brokers platforms to your account

- Maximum level of safety guaranteed

- Account protected up to $250,000 by Securities Investor Protection Corporation (SIPC)

![]() Cons:

Cons:

- Time-consuming account opening process

- Money transfers by bank transfer only

- OptionStation PRO is not available

- Not as accessible for beginners

TRADESTATION GLOBAL: Pros and Cons Uncovered

In this review we analyze a peculiar product but one with great potential, born from the combined action of two of the world's leaders in the online trading landscape.

This synergy made it possible to gather the strengths of both entities, making the weaknesses that characterized each of them superfluous.

Let's talk about TradeStation Global, a trading account created from the combination of TradeStation US and Interactive Brokers.

Those who have a TradeStation US account cannot trade all products, such as Forex or CFDs, nor can US users access markets such as the European stock markets, IDEM and Euronext. TradeStation Global solves that problem.

Those who have an Interactive Brokers account and want to code and backtest their strategies but cannot do so on IB Trader Workstation (TWS). TradeStation Global solves that problem.

Those who have never had an account with either broker can now take advantage of all the advanced services offered by Interactive Brokers, while having the ability to integrate the TradeStation platform, one of the most popular platforms in the trading community, for free.

In the following sections you will find our in-depth analysis and unbiased opinions for 8 different categories.

Is opening a TradeStation Global account the right choice for higher level traders, or are there other solutions for advanced online trading?

Safety

How safe is it to have an account with TradeStation Global?

To answer this question, we must shift the spotlight to Interactive Brokers, since the account resides under the jurisdiction of IB. When choosing a broker, one of the first steps must be to ascertain the intermediary's reliability and safety. Only once the security criteria are met, can you move to evaluating other parameters. That said, we can presume that Interactive Brokers ranks among the safest brokers in the world. Let's see why.

We have studied the Client Agreement in detail (the Agreement with the Client, only available in English). Let's start by clarifying that UK clients open an account with Interactive Brokers U.K. (IB UK), the European subsidiary of Interactive Brokers LLC, with the parent company headquartered in the United States. IB LLC is a listed company on the NYSE (ISIN: US45841N1072) and has received a BBB+ rating with a stable outlook from Standard & Poor's.

IB UK has been authorized by and is supervised by the UK Financial Conduct Authority (FCA), one of the most stringent and reputable regulatory bodies in the world. Interactive Brokers is an execution-only broker, which means that it cannot provide any advice or promotion of financial instruments, it can merely send client orders to the trading venues. This setup also defines IB as a DMA broker that does not act as a Market Maker in any way.

The US Financial Services Compensation Scheme (“SIPC”) applies to this online broker, but how? This scheme is a real insurance that covers cases in which the intermediary becomes insolvent, for a maximum amount of up to $250,000 (where the European compensation scheme is €20,000). Should a negative event occur for the broker, your funds are still covered by this fund up to that maximum amount.

Login and Security

Access to the TradeStation Global account takes place on two levels: First, you need to log in with your username and password. At this point the system will ask you to enter a code that will be received via SMS on your registered mobile number. For those who want to avoid receiving SMS, it is possible to enable the so-called two-factor authentication on the Interactive Brokers app. After entering the username and password, the system will confirm the login request from the app in order to access the account.

Two-factor authentication login allows you to keep hackers and account access attempts by malicious bad actors at bay.

For the reasons listed above, opening a TradeStation Global account allows you to benefit from the highest security conditions.

TradeStation Global Account

Opening an account may leave one a little perplexed by its complexity. To open an account with TradeStation Global you will first need to specify whether you are an existing Interactive Brokers client or want to open a new account from scratch. Both natural and legal persons can become customers. It is also possible to jointly hold the account between two natural persons.

Next, you will need to enter your personal data and accept the conditions, after which you will be directed to the Interactive Brokers website to complete the registration (from a legal point of view, an Interactive Brokers account is activated).

To verify your identity, you will need:

- An identity document (passport, driving license or identity card);

- A proof of residence not older than 6 months (for example a utility bill or bank statement).

Once the account opening request has been approved (in this case it took 3 working days), you will be able to make a deposit that will be used to feed the newly opened trading account. In this regard, the only option available is to arrange a bank transfer, whose recipient is Interactive Brokers and whose IBAN is German (therefore a SEPA transfer must be made). The transfer can be done in the currency of your choice.

Overall, registering an account was quite cumbersome and far too long. This is largely due to the stringent requirements of the American legislator. Although tedious, this procedure guarantees that the security standards are high with this broker.

What is the minimum deposit for TradeStation Global?

Until a few months ago, the minimum deposit required to open a TradeStation Global account was $1,000. Now, however, you can activate the account with any amount. You can fund the account with a minimum deposit starting from $0.01. Once the transfer is credited, it will be time to install and configure the trading platforms.

First, you will need to download and install Interactive Brokers TWS. Once you have logged in with your username and password, you will need to configure the API settings to allow the TradeStation platform to integrate with TWS. The TradeStation team will send a detailed email with all the instructions to follow for this process.

Products

Accountholders on TradeStation Global will benefit from Interactive Brokers' market options and tools. In this respect, Interactive Brokers outperforms the competition, providing access to 120 markets in 26 countries in 22 different currencies. No other broker is able to come close to this offer (especially European ones).

Negotiable products offered on IB include the following:

- Stocks

- ETFs

- Options

- Futures

- Investment funds

- Bonds

- Forex

- Commodities

- CFDs

Those who already have an account with TradeStation US will notice that some products (i.e. Forex) are negotiable with TradeStation Global even though they are not available with the US account.

This account opens the doors not only to all the main markets (i.e. North American and European markets) but also to exotic markets. For example, you will have access to the Mexican, Australian, Indian, Korean stock exchanges, etc. OTC stocks and Pink Sheets are also available on the US stock market.

The options of many global markets are available, in particular the options on US shares are very attractive, as it is a market that most UK brokers do not offer. The options, however, are tradable through the TWS (OptionStation Pro is not available), while you can safely analyze and backtest the underlying securities through the TS.

For those who wish to trade on Forex, 23 major and secondary currency crosses are available.

The offer of bonds is somewhat limiting, given that the Xetra is missing. On the other hand, US bonds (both government and corporate), bonds listed on Euronext and those of the Hong Kong stock exchange are available.

Commissions and Costs

TradeStation Global offers a variable fee structure for global equity markets (with the exception of the US markets where the number of shares traded is considered) and a fixed fee structure for derivatives (i.e. futures and options).

With other English brokers the cost of commissions decreases as the number of trades increases. With TradeStation, the commission structure does not change based on the frequency of trading; whether you make one, 100 or 1,000 trades per month, the rates will always be the same. However, you can try to negotiate the conditions in your favor if you are a professional trader who trades with large volumes.

A flaw that TradeStation has in common with Interactive Brokers is that of keeping commission costs (those directly attributable to the broker) separate from external costs not attributable to it (i.e. the stock market costs the broker faces to execute transactions). In a nutshell, it is necessary to add stock exchange and clearing costs to the commissions set out in the tariff displayed in the dedicated section of the TradeStation website.

Now let's go into the details of the trading commissions in order to make a comparison with the rates of the main brokers available for UK traders.

For all European stocks and ETFs (including London Stock Exchange) the commission is 0.12% of the traded value. The minimum depends on the currency of the transaction: €1.75 / CHF 2.25 / USD 2.50 / GBP 1.50.

As mentioned above, the costs of the external stock exchange must be added to this amount. European investment funds, on the other hand, always cost 0.12%, but with a minimum per order of €2.00.

Example 1: Purchase €2,000 of German shares. The commission will be €2.40 (0.12% of €2,000) and approximately €1.00 of external costs. Total commission: €3.40.

Example 2: Purchase £5,000 of UK stock. The commission will be £6.00 (0.12% of £ 5,000) and approximately £0.30 in external costs. Total commission: £6.30.

In conclusion, the fees for stocks and ETFs listed on the UK markets are average and affordable especially for low to medium amounts. But beware of transactions with a high value, since there is no limit on commissions, you risk paying high fees. TradeStation's rates for European equity markets are better than those of its competitors, with commissions starting from €1.75, regardless of the volumes traded.

Let's now turn to American stocks. For US markets, the fees are $0.007 per share bought/sold. The minimum order fee is $1.00. For Canadian markets, one will pay 0.012 CAD per share, with a minimum of 1.50 CAD. Here, too, one must add the stock market costs, which are between $0.002-$0.004 per share.

Example: Purchase 100 Apple shares (with a price of approximately $200 per share). The unit fee will be $0.70 (100 shares x $0.07) + $0.30 in external costs. The total commission will be $1.00.

For the American markets, therefore, only DEGIRO can compete with this level of commissions. Fees for futures and options globally are also very competitive. Futures denominated in GPB cost £0.95 per contract and US futures are $1.70 per contract.

On the other hand, options cost £1.50/$1.50 per contract. The usual external costs are added to these commissions, which for derivatives vary from £0.50 to £1.00 per contract. Low commissions combined with state-of-the-art platforms make TradeStation one of the best brokers for trading futures and options. To calculate the cost of commissions on bonds, the formula is as follows: 0.15% * nominal value of the bond. The costs for Forex are also interesting, where the spread starts from 0.6 pips. Money deposits are always free. For cash withdrawals, on the other hand, one withdrawal per calendar month is free. Subsequent withdrawals cost $10 per withdrawal.

Trading Platform

As previously stated, with TradeStation Global you technically open an Interactive Brokers account. However, it is possible to enhance this account by taking advantage of the state-of-the-art technology of the TradeStation platform. Imagine buying a car from a car manufacturer (Interactive Brokers) but with the engine of another team (TradeStation) mounted inside. In this case, therefore, you will open an Interactive Brokers account, while having the ability to take full advantage of its security, various products and bags etc.

In addition, you will have the possibility to integrate the TradeStation platform into your account (for free). You will therefore be able to trade through one (or more) of the following platforms:

- The TWS

- Interactive Brokers mobile app

- The TradeStation 9.5

- The Interactive Brokers web platform

The TradeStation app and web platform are not available, both of which have been replaced by Interactive Brokers. There is also no OptionStation PRO for creating options strategies.

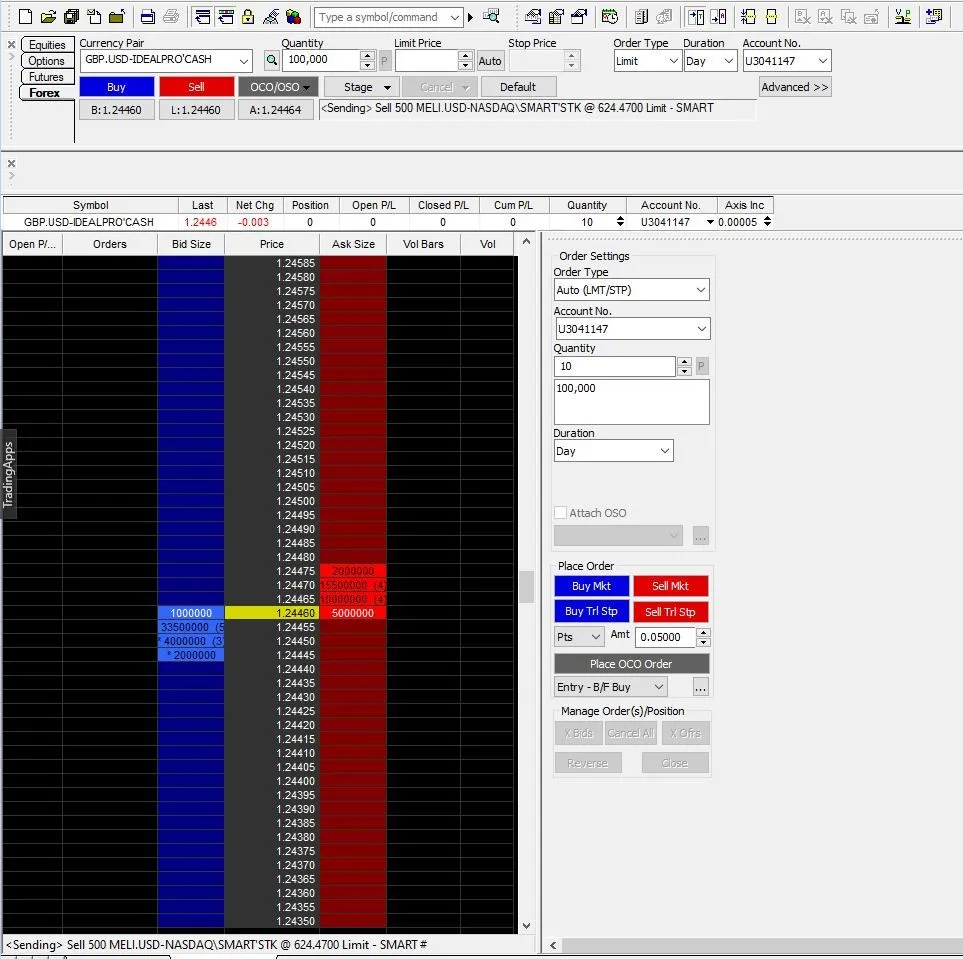

TWS

TWS is Interactive Brokers' reference platform. It is meant for experienced traders. A novice investor should therefore think of initially approaching the more user-friendly web platform. This is due to the fact that within the TWS there is a myriad of tools, analysis and research support, etc. that only those with advanced knowledge and operations will find useful. The TWS is customizable in almost all respects: from graphs to research and analysis. Once TWS is launched, you can decide whether to use TWS Mosaic or the classic TWS.

TWS Mosaic has an interface rich in content. The order management takes place on the left side of the screen; the right side is dedicated to research and analysis of financial instruments; and at the bottom there is market news and a summary of portfolio activities.

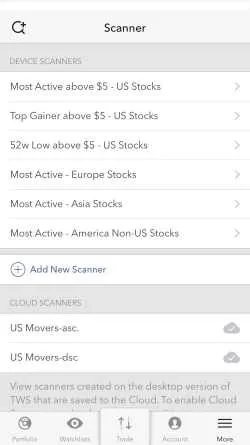

Market Scanner

The TWS Market Scanner allows you to quickly explore the various markets in search of the instruments of your interest, based on the parameters selected by the trader.

Research Shortable Titles

The operation of many traders involves the short sale of securities that they do not own. Interactive Brokers has a very practical and useful tool that allows you to find out in real time if a stock is available for short selling (and if successful, in what quantity).

You must go to the account management page, choose the "Short Stock (SLB) availability" tool, then enter the ISIN and the reference exchange of a product in order to obtain its availability for short-selling. The tool is also available within TWS, whenever a product sheet is opened.

The app

For those who want to trade via mobile devices, TradeStation Global allows you to use only the Interactive Brokers (IB) app.

The IB app has a majority of the features available on the desktop platform, albeit recovering many points in terms of ease of use and practicality.

The app allows you to perform the main functions, such as portfolio management, product search, order entry and quotes.

In addition, by installing the app on your mobile device, you will always have many tools at your fingertips:

- Watchlist

- Tool for exercising options

- Economic calendar

- Alerts

- Scanner (can be synchronized with that of the TWS via Cloud)

- Daily news (articles and broadcasts of the main financial TVs such as Bloomberg TV)

The customization of the charts is also significant to note, to which it is possible to apply almost all the technical analysis indicators (in push mode). The charts are also shown by corporate and financial news depending on the stock being analyzed.

TradeStation 9.5

Like TWS, the TradeStation platform is also aimed at advanced traders. Before going into the analysis, we must specify that the use of TWS does not preclude the use of TradeStation 9.5 (and vice versa).

You can use both at the same time, one to complement the other.

RadarScreen

RadarScreen is a scanner that allows you to apply, in real time, both technical and fundamental indicators to a list of instruments. To use it, you must indicate the type of instruments to be monitored. Afterwards, it will be possible to group these tools into different sections. The RadarScreen allows you to add alerts, prices and indicators to the tools in the list. This tool also has the advantage of being highly customizable (customization is the biggest perk of the TradeStation platform) to the trader's preference, it can be reconfigured to one's liking.

Matrix

The Matrix window displays the depth of the book with the bid, the ask, the prices and volumes of the instrument. Prices are sorted vertically and different colors are used to identify transactions between the lows and highs of the day. As with the RadarScreen, the Matrix is also highly customizable, and it is possible to change the language of the indicators, as well.

EasyLanguage®

EasyLanguage® is the proprietary programming language created for TradeStation traders. It allows you to create trading strategies with algorithms, custom technical indicators, etc. with a code that is user-friendly. This language was initially created with the aim of being accessible for those traders without advanced computer skills. The commands are composed, for the most part, in English and that is why EasyLanguage® is easier to learn than other similar programming languages.

Web Platform

The web platform is undoubtedly the most suitable solution (together with the IBKR app) for traders with little to no experience. This type of investor will prefer to do without the advanced tools, present on both TWS and TradeStation 9.5, as long as they have a more user-friendly trading environment.

Here the trader can easily search for products from the search engine, consult the charts (without being able to customize them), enter buy/sell orders and create a watchlist.

From the web platform you can have your wallet under control at any time, make money transfers and have access to reporting.

Through the web platform, therefore, the most basic operations can be performed. For technical analysis, filter searches, the entry of advanced conditional orders, desktop platforms will have to be used.

Tax Regime

Since IB is a US broker with headquarters in the United States, for tax purposes it must be considered as a foreign broker. As a result, the money and securities held by IB must be considered as financial assets held abroad.

Depending on the country in which you are a fiscal resident, there will be taxes to be paid, generated by the trading activities with IB. In this regard, we suggest contacting a tax advisor to fulfill all tax obligations.

Customer Support

The TradeStation Global website has a very comprehensive FAQ section, where you can find the most common questions and answers regarding account opening, costs, platform configuration, etc. If the answer to a question is not found in the FAQ, you can contact TradeStation customer support.Please note that you will need to contact the TradeStation Global Service Desk (

Education

TradeStation is an advanced platform, therefore not suitable for those who are taking their first steps in online trading.

What does this mean? It means that those who have at least some basic knowledge can consider using this platform. Better still, if you have already gained experience (with real money) with other platforms and brokers, TradeStation is an option for you.

For this reason, the educational material made available by TradeStation does not start from the basics, but from an intermediate level to which the intended user is presumed to belong.

There is a video section on the TradeStation Global website. In Italian we can find 3 videos that explain how to use the platform:

- Basic video: where the basic functionalities of the platform are introduced

- Intermediate video: explaining how to customize the charts and use the platform tools

- Advanced video: for those who intend to perform mechanical trading, in this video they will find an explanation on how to code and how to do the Backtest of the strategies

For UK brokers, there are a selective number of videos with video tutorials and webinars, both of which cover a large number of topics related to the use of the (complex) platform.

Overall, therefore, this broker limits itself to providing educational material that has the exclusive objective related to its trading platform, assuming an already high level of knowledge and experience of the trader to whom it is addressed.

For those who want to study technical subjects, it is suggested visiting the Interactive Brokers educational center, where the materials and topics are covered abound.

Overall Rating

In conclusion, opening an account with TradeStation Global is overall a winning choice from several points of view. TSW’s trading commissions are excellent, while account keeping costs are fairly average, especially considering the quality of the instruments that are available to the trader. The offer of markets and financial instruments is amongst the widest: coverage is almost total, with access to both main and exotic exchanges. The account opening process is rather slow and cumbersome and it is only possible to fund the account by bank transfer. The trading platforms of TradeStation and Interactive Brokers have maximum efficiency, but they are aimed at expert users. Novice traders can still consider using the simpler web platform and app. In terms of security, TradeStation Global is overseen by the strictest regulatory bodies in the world (FCA and SEC). Client accounts are also backed by the US Compensation Scheme, which covers each account up to $250,000.

We therefore recommend opening a TradeStation Global account if you are looking for a modern, efficient and advanced online broker. Don't expect a simple trading environment though, as advanced services require an equally advanced level of preparation and skills.