Summary:

- Broker based in Australia with offices in Europe, Asia and Latin America

- 5 tradable asset classes

- Supported trading platforms are MT4, MT5 and TradingView

- 2 account types offered

![]() Pros:

Pros:

- Competitive spreads from 0.1 pips and advantageous fixed commissions

- Demo account with virtual money to test platforms

- Minimum deposit of 100€

- Fast and commission-free deposits and withdrawals

![]() Cons:

Cons:

- Only CFD trading available

- Lack of teaching materials on the website

Eightcap online broker: who it is and how it works

In this review, we analyse and evaluate Eightcap, an online broker founded in Australia in 2009 and now active globally (including the UK) with numerous offices worldwide.

Eightcap is a CFD broker that allows trading in forex, indices, commodities, shares and cryptocurrencies.

This broker is enjoying considerable success as it can offer European customers, depending on the jurisdiction, leverage as high as 500x.

In the course of this review, you will find all relevant information on Eightcap regarding security, costs, trading conditions, products and markets offered. In the final section, you will find our opinions on Eightcap and our final verdict on the Australian broker.

Safety

Eightcap operates under the regulatory oversight of several reputable global financial authorities, including the Australian Securities & Investment Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, the Securities Commission of The Bahamas (SCB) and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

Eightcap is constantly committed to the highest standards of transparency, customer protection and operational integrity.

In addition, Eightcap protects clients' funds by keeping them in segregated accounts with top financial institutions.

The company employs stringent technology and security protocols to provide additional safeguards for customers' personal and financial information.

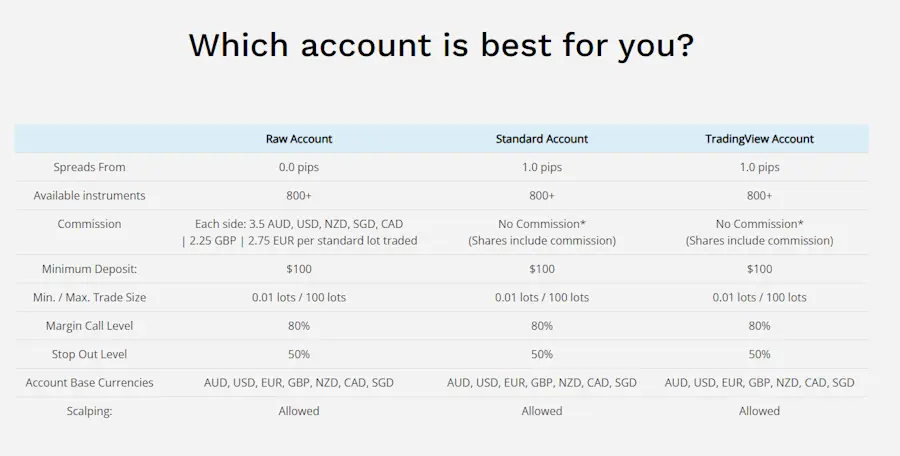

Account types

Eightcap offers its clients two account types: the Raw Account and the Standard Account. Let us see the main differences between the two accounts.

Raw Account

The Raw Account has spreads starting at 0.0 pips and a fixed commission of $3.5 per trade. Due to the fixed commission adopted, the Raw Account might be preferable for active traders, as it would allow them to benefit from the reduced spreads and, at the same time, offset the commission costs.

Standard Account

The Standard Account has no trading commissions but only spreads starting at 1.0 pip. Unlike the Raw Account, with the Standard Account it will be convenient to trade with smaller amounts, as there are no commissions to pay, only spreads.

The only substantial difference between the two account types lies in the commission structure seen above. All other conditions for the Raw Account and the Standard Account are identical: from the minimum deposit to the available leverage and the required margin levels.

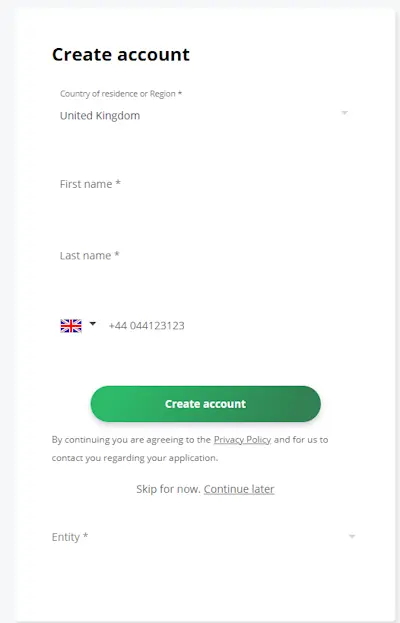

Account opening

Registering a new account with Eightcap takes approximately 10 minutes. The entire procedure takes place online via the broker's website. After filling out the online form, you will be asked to provide documents for identity verification.

Once the application is approved (usually within 12-24 hours) you will receive credentials to access your trading account.

» Money deposits and withdrawals

Eightcap provides numerous methods for clients to deposit and withdraw money from their trading accounts:

- Debit/credit card

- Bank transfer

- Crypto

- PayPal

- Skrill

- Neteller

- Interac

- uPop and others

Deposits made via these payment methods are always free of charge and immediate (except bank transfers, which can take between 1 and 5 working days to be credited).

Withdrawals are processed within 24-48 hours and are usually completed within 5 working days.

Eightcap does not charge any internal fees for deposits/withdrawals, but there may be fees associated with the payment service provider, particularly for e-wallets such as Skrill and Neteller.

» In which currencies can the account be opened?

When opening the account, you can choose the account's base currency from the 7 available:

- EUR

- USD

- GBP

- AUD

- CAD

- NZD

- SGD

The base currency chosen will be used for all money deposits and withdrawals.

» What is the minimum deposit with Eightcap?

For both the Raw Account and the Standard Account, the minimum deposit required is 100€ (or the equivalent of the account's base currency). This relatively low minimum deposit, compared to other online brokers, makes it easier to start trading.

» Is there a virtual account with Eightcap?

Yes, Eightcap offers a virtual account with simulated funds, which is useful to test the broker's platform and services before opening a live account.

Once activated, the demo account is valid for 30 days.

Products and Markets

On which financial assets and markets can you invest with Eightcap? Eightcap allows you to trade - via CFDs - on 5 asset classes:

- Forex: 40 available major, minor and exotic currency pairs

- Raw materials: Gold, Silver and Oil CFDs are available for trading

- Indices: 7 global indices are available including the Euro Stoxx, DAX and Dow Jones

- Stocks: major stocks on the US, UK, German and Australian stock exchanges are available. CFDs on equities are tradable exclusively on the MT5

- Cryptos: CFDs available on MT5 on 4 cryptocurrencies including Bitcoin, Litecoin, Ripple and Ethereum

With Eightcap, you have available the main assets for investing, although the range of tradable products is not the widest (in total, around 800 products are negotiable).

However, we understand that the broker continues to expand the offer to its customers.

» Financial leverage

One of the factors that make Eightcap among traders' favourite brokers is the leverage offer of up to 1:500.

Specifically, here are the maximum levels of leverage allowed for each asset class:

- Forex: leverage up to 1:500

- Raw Materials: leverage up to 1:500

- Indices: leverage up to 1:200

- Stocks: leverage up to 1:5

- Cryptos: leverage up to 1:20

We emphasise the importance of using such high leverage only if you have a sufficient level of experience. Leverage amplifies not only potential profits but also losses.

It is essential to use leverage with caution and employ appropriate risk management strategies to protect your capital.

Fees and Costs

The trading fees charged by Eightcap depend on the type of account used: Raw Account or Standard Account.

The Raw Account has a fixed commission of $3.5 per trade and spreads from 0.0 pips.

The Standard Account is a zero-commission account with variable spreads starting at 1.0 pip.

To summarise, therefore, with the Raw account you can benefit from tighter spreads but for a fixed commission of $3.5.

For trading CFDs on shares, a fee of $0.02 per share applies for both accounts, with a minimum of $4.

If open positions are held overnight, rollover costs (swap rates) must also be taken into account. These costs are variable depending on the tradable asset but are communicated ex-ante by Eightcap within the platform.

Let us now analyse the costs of maintaining an Eightcap account.

As mentioned in the section on account types, on the Eightcap side there are no additional fees for deposits or withdrawals.

Opening, maintaining and closing the Eightcap account is completely free of charge.

Should the account be inactive for more than 6 months, Eightcap may charge administrative fees due to inactivity. We recommend that you log in from time to time or withdraw funds from your account if you no longer intend to continue using it.

Trading platform

Eightcap does not offer proprietary trading platforms but third-party software:

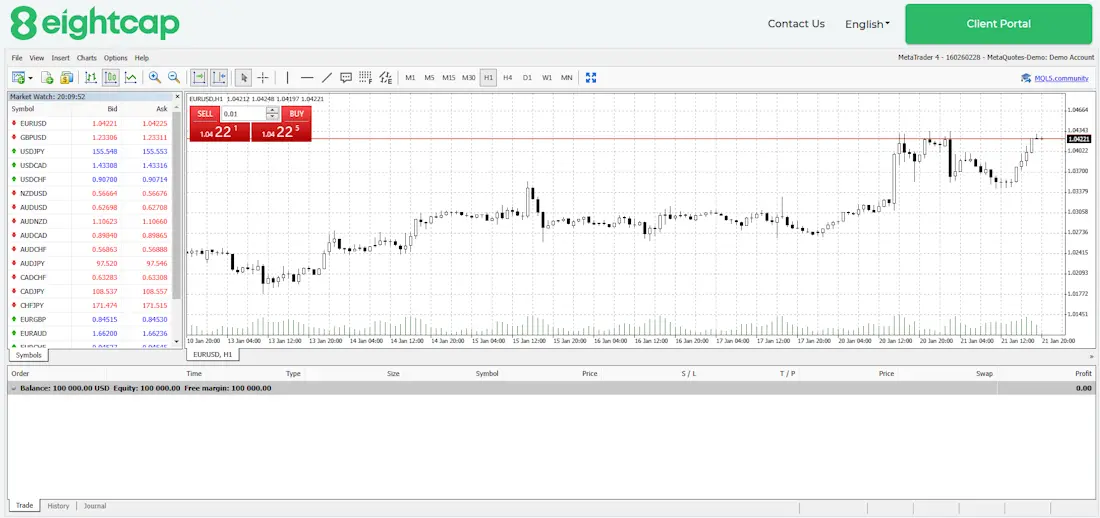

- MetaTrader 4

- MetaTrader 5

- TradingView

MetaTrader 4

It is probably the most widely used trading platform worldwide, particularly for CFD trading. Its popularity stems from its intuitiveness and ease of use. With MT4, you can trade Forex, Commodities and Indices.

Since it is a desktop platform, to launch it you need to download the software and install it on your computer or smartphone/tablet.

The main strength of MT4 is the possibility of creating automatic trading strategies. Expert Advisors (EA) are tools that allow you to invest using automatic trading software on MetaTrader 4, following different rules for entering and exiting the market.

MetaTrader 5

MT5 is a faster and more powerful platform than MT4. However, one does not replace the other, as each offers unique features.

As with MT4, MT5 also requires downloading and installing the software. In addition, a web version is available, i.e. it can be launched directly from the browser.

If you want to trade cryptocurrencies or shares with Eightcap, you will need to use MT5 (on MT4 such assets are not available).

TradingView

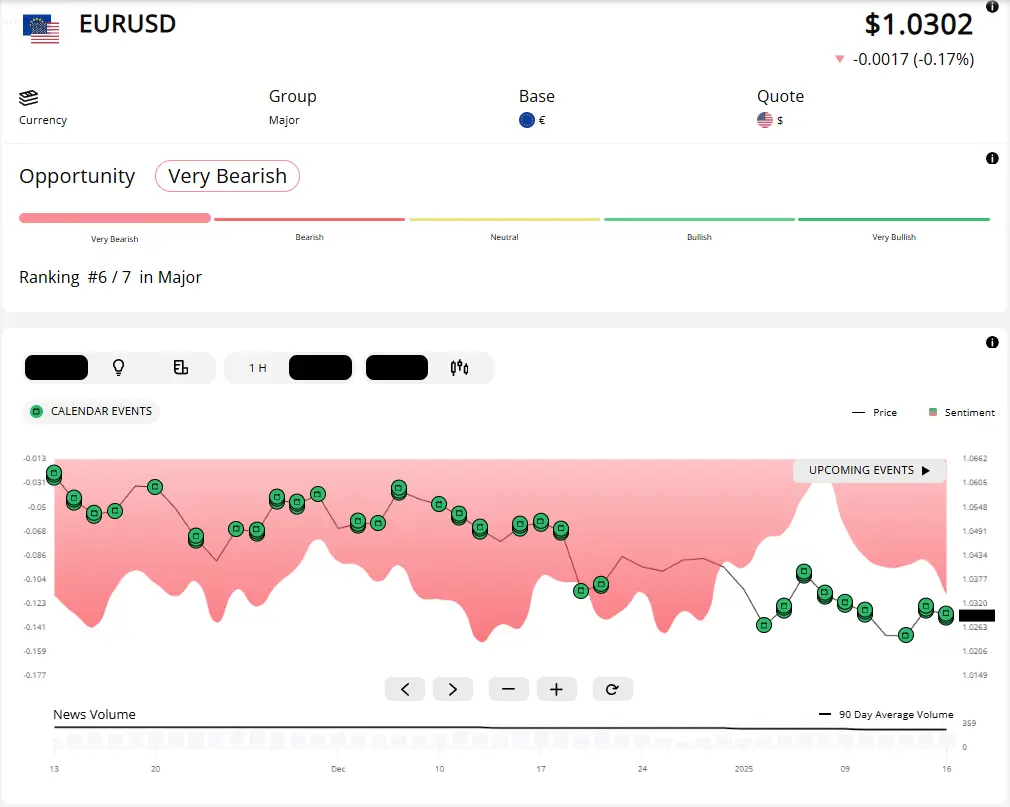

Eightcap offers the possibility to link your trading account to TradingView, one of the most popular platforms used by beginners and experienced traders alike. TradingView is a platform of charts and analysis tools, through which you can also use a programming language to create Trading Systems.

Customer Service

Eightcap offers customer support in several languages. The channels through which assistance is provided are:

- Live chat

- Phone

From our cross-testing, Eightcap's customer service is efficient and prompt in responding to clients, especially via the live chat service, where immediate assistance is provided.

Final verdict

Having reached the end of this review on the online broker Eightcap, following our analysis our verdict on this broker is positive.

Eightcap passes our tests on Security, Platforms, Costs, Customer Service and Trading Conditions with flying colours.

Its strength is the leverage offer of up to 1:500, which makes it in our opinion the best high leverage broker currently available to traders.

We hope that in the future it will be able to offer more educational materials and a training service for users who are just starting in the world of online trading.

Discover the trading tools of QualeBroker: