Summary:

- Fractional shares offered starting from 1€

- 7,000 tradable stocks and ETFs

- CFD trading on 4 asset classes

- Funds protected up to €20,000

![]() Pros:

Pros:

- Zero commissions for real stocks and ETFs

- Virtual account offered

- Minimum deposit 1 GBP

![]() Cons:

Cons:

- High costs for CFD trading

- No assistance provided by phone/chat

- Fees for currency conversion

Pros:

Zero commissions for real stocks and ETFs.

Virtual account available.

Regulated and supervised by FCA.

Minimum deposit 1 GBP.

Cons:

High costs for CFD negotiations.

No assistance provided by phone/chat.

Commissions for currency exchange.

The onboarding of new clients is currently suspended.

Trading 212 is an online broker whose services are offered by Trading 212 UK Ltd. Founded in Sofia, Bulgaria in 2004, it has had its head office in the UK since 2013.

Trading212 was created to make online trading accessible to all and with no commissions. Its app is one of the most downloaded in Great Britain with over 15 million downloads to date.

Trading212 offers a multi-asset platform that allows you to make investments in shares (including fractional shares) and real ETFs, as well as trading CFDs.

Let's try to get a better understanding of what Trading 212 services consist of, analyzing all aspects relating to security, costs and features of the platform.

Safety

When it comes to discussing online brokers to rely on, the first questions are: Is this broker reliable and transparent? How can we evaluate its reliability and transparency?

First, one needs to make sure that the broker has the proper licenses to operate and that it is supervised by a legitimate financial authority.

Another important topic involves customer funds and how they are held and protected, especially in the case of a possible default of the broker itself.

So let's now try to answer these questions starting with the corporate structure and the history of Trading 212.

Trading 212 boasts nearly twenty years of experience in the field of financial services, originating in Sofia, Bulgaria.

Trading212 serves its clients in the United Kingdom through Trading 212 UK Ltd which has its registered office in the UK.

Trading212 is therefore regulated and supervised by both the UK's Financial Conduct Authority (FCA) and Bulgaria's Financial Supervision Commission (FSC).

Trading 212 adheres to the Financial Services Compensation Scheme (FSCS), which is an investor compensation scheme that guarantees up to £85,000. Insurance comes into play when, in the unlikely event of default of the broker, the latter is unable to provide a refund to the customer.

Client funds are segregated in third-party institutions which means that, in the event of particularly negative scenarios such as the broker's default, these funds cannot be attacked by third parties as they are separated from the broker’s funds and kept in other institutions.

As required by UK regulations, each account is protected against a negative balance. This means that in the event market conditions lead to a negative balance in your trading account, it is the broker itself that is responsible for absorbing this loss.

Thus, with Trading 212 you don't risk losing more than what has been deposited into your account.

Trading212 also pays particular attention to the security of the platform and therefore to personal data and information. To do this, it has entrusted the US certifying body, Security Metrics, with the monitoring of applications and infrastructures which is carried out through penetration tests and regular scans.

Finally, a dedicated security centre continuously monitors and analyzes traffic to detect any critical issues in real-time.

For security, we can conclude that Trading 212 possesses all the requirements to guarantee an adequate level of security to its customers.

Trading 212 Account

Trading 212, in addition to the real account, also provides a demo account. An interesting option both for those who are taking their first steps in the world of trading and for those who want to test the platform features before opening a real account.

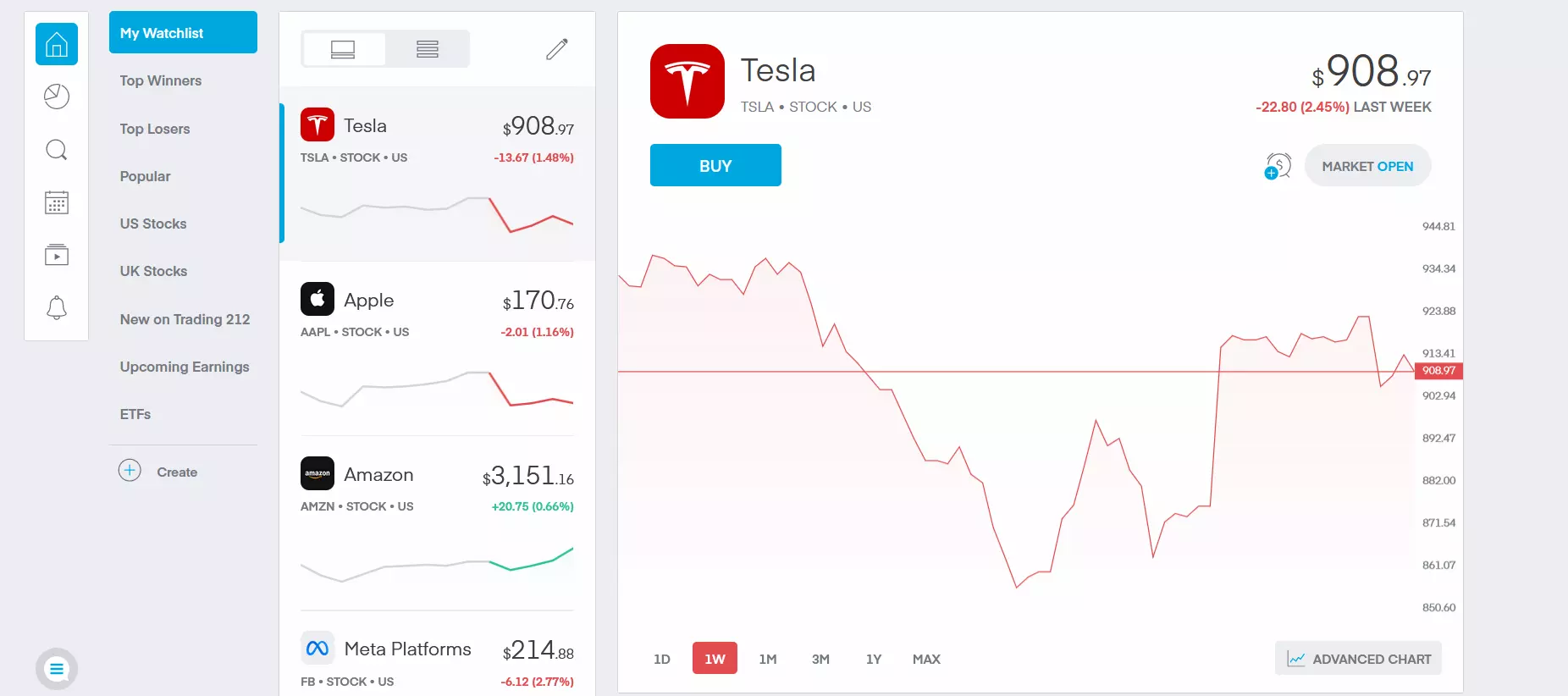

The platform is available in both web and mobile versions via an app for both real and demo accounts.

Trading 212 offers two types of accounts: Trading Invest and Trading CFD.

Let's go through them.

Trading Invest operates as a direct market, i.e. traders’ buy and sell orders are directly forwarded to the reference exchanges. With the Invest account, you can therefore to negotiate real shares (including fractional ones) and ETFs, all without commissions relating to the trades.

The minimum investment is £1, thanks to the possibility of investing in fractional shares that allow you to create a diversified portfolio without a large amount of money.

With Trading CFD you can negotiate CFDs on various asset classes including Forex, stocks, commodities, and indices, although with more limited access to financial markets than the Invest account.

With the CFD account, Trading 212 operates as a Market Maker, i.e. it acts as a counterparty in the negotiations of its clients. In this case, the trader operates on synthetic products and does not buy the underlying asset, as is the case with the Trading Invest account.

By opening a single Trading 212 account, you will be able to access both types of accounts and the related platforms available.

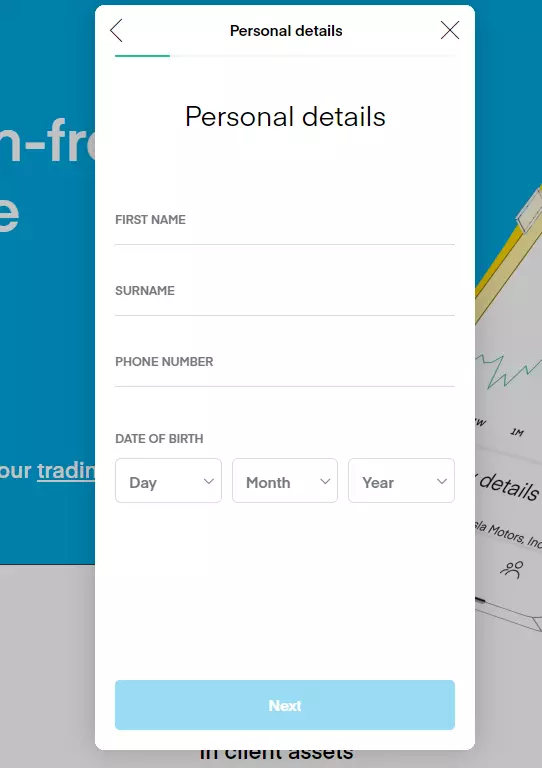

» Account Opening

The account opening process is quick and easy. Filling in the online form takes only 5 minutes and involves the following steps:

Entering personal data

Uploading an identity documentation and proof of residence

Compilation of the MiFID questionnaire, to certify the level of financial knowledge

Verification of the account takes place within 2-3 working days

However, please note that Trading 212 is not accepting new clients at the moment. It is not yet clear when the opening of new accounts will start again.

» Which foreign currencies can the account be opened in?

Trading212 account supports the following currencies: GBP, EUR, USD, RON, PLN, CHF, NOK, SEK, CZK. However, it should be noted that only 2 or 3 currencies are available for each country.

For UK clients the only available currencies are GBP and USD.

If you wish to make several trading transactions in multiple currencies, please note that, since there are commissions applied for the conversion of currencies, we suggest you associate a multi-currency bank account, such as Revolut, to the Trading 212 account.

This way, you will be able to deposit and withdraw funds in different currencies without incurring costs for currency conversion within the platform.

What is the minimum deposit to open an account with Trading 212?

For both account options, there is a very low minimum initial deposit, which is one of the main advantages of the Trading 212 account.

For the Trading Invest account the minimum deposit is £1, while for the Trading CFD account, it is £10.

Trading 212: interest on cash

Trading 212 pays interest of up to 7% on the uninvested cash in your account.

There are no limits or restrictions. Cash in the account may be withdrawn or invested at any time without penalty or loss of accrued interest. No minimum amounts are required to enable interest to accrue, nor are there any maximum limits.

To start earning interest with Trading 212 simply enable the service:

by logging into your account

clicking on "Earn interest on cash"

following the instructions

clicking on the "Enable" button

Both the calculation and payment of interest take place on a daily basis.

The annual interest rate varies depending on the specific currency as follows:

EUR: 4.2%

USD: 5.1%

GBP: 5.2%

CHF: 1.5%

HUF: 7%

PLN: 6%

CZK: 6%

RON: 5%

DKK: 2.5%

NOK: 3%

SEK: 3%

CAD: 3.5%

BGN: 2.5%

Products and Markets

The assets that can be traded on Trading 212 vary according to the type of account. For both the Invest account and the Trading account, commissions are always zero for any transaction made. However, one must be careful of the bid-ask spread.

Let's get into the details to see all the assets available for each type of account.

With the Trading Invest account, it is possible to trade shares and ETFs, purchasing and selling real shares with the possibility of choosing from approximately 10,000 shares and ETFs with direct and immediate execution on the main exchanges.

The Trading Invest account allows the trader to make investments starting from £1 thanks to fractional shares that allow one to create a diversified portfolio even with a small amount of funds.

Here is the list of all the stock exchanges offered:

London Stock Exchange - both stocks and ETFs

German stock exchange - both stocks and ETFs

NYSE - both stocks and ETFs

NASDAQ - both stocks and ETFs

Dutch stock exchange - shares only

Swiss stock exchange - equities

Spanish Stock Exchange - Stocks Only

For the CFD Trading account, the expected assets are:

Indices: over 30 indices

Forex: over 150 currency pairs

Stocks: over 10,000 stocks including Apple, Tesla, Lloyds

Commodities: gold, oil, silver, coffee, and many other commodities

Financial Leverage

Trading 212 is a London-based broker and it must abide by ESMA regulations of the financial industry, which requires brokers to offer clients a maximum leverage of x30.

With Trading 212 the maximum leverage varies depending on the type of asset traded:

for major currency pairs the maximum leverage is x30, for secondary or exotic currency pairs it is x20

for major indices the maximum leverage is x20, while for non-major indices it is x10

for commodities, the maximum leverage is x10, except for gold for which the maximum leverage is x20

for stocks and ETFs the maximum leverage is x5

The above information relates to the Retail version of the account. If you want to trade at higher levels, you will need to become a PRO client.

Trading Fees and Costs

To answer the question of how convenient it is to use Trading 212, we must first differentiate between the costs arising from trading activities and the costs inherent in the account itself.

Let us look in more detail at what our analysis has revealed.

» Trading 212 Commissions

As far as commissions are concerned, as already mentioned, neither the Trading Invest nor the Trading CFD accounts apply commissions.

In fact, with brokerTrading 212 it is possible to open and close positions without paying any commissions for the transaction made.

On the other hand, the other cost items related to trading operations differ according to the type of account:

For the Trading Invest account, there is no cost for positions left open until the next day (overnight)

For the CFD Trading account, for each position left open every day, interest will be credited or debited to the account based on the SWAPs

Different rollover costs are depending on the trading instrument used:

Forex: 0.09%

Raw materials: 0.27%

Futures: 0.05%

Equities: 0.43%

The required margin also varies depending on the trading instrument:

Forex: for major currency pairs - 3.33% / for secondary currency pairs - 5%

Commodities: gold - 5% / Other commodities - 10% (for clients with capital above € 25,000 Trading212 reserves the right to request a higher margin)

Equities: 20%

Indices: basic indices - 5% / Secondary indices - 10% (for accounts with capital greater than € 25,000 Trading212 reserves the right to request a higher margin).

One can see how CFD trading fees are quite high compared to other similar brokers such as eToro and Plus500.

In our opinion, therefore, from a commission point of view, it may make sense to use Trading 212 only through the Invest account, or for the commission-free purchase of real shares and ETFs.

» Trading 212 Costs

Now let's go through the costs related to the Trading 212 account, i.e. those that do not derive from trading operations.

Trading Invest account:

No account opening costs

Payments always free by bank transfer

Free deposits via credit / debit cards, Google Pay, Apple Pay, Skrill, iDeal, DotPay, GiroPay, Sofort (for payments up to £2,000 over which a 0.7% commission is applied)

Free withdrawals

0.15% currency exchange fee

CFD Trading Account:

Free account opening

0.5% currency exchange fee

Free deposits and withdrawals

Trading Platform

Trading 212 allows its customers to trade both through a proprietary web platform and a dedicated app.

There is no desktop version of the platform at the moment (i.e. software that can be downloaded and installed directly on the computer).

Both the web platform and the Trading 212 app are useful to users with little or no experience. Both are very easy to use. The absence of advanced analysis tools is the negative of this trading environment developed for beginners.

» Two-Factor Authentication

Two-factor authentication (2FA) allows you to increase security on your Trading 212 account. By activating this feature through the app, for each login attempt you will need to enter a code that Trading 212 will send via SMS. In our opinion, two-factor authentication is essential to avoid third-party access or hacking attempts on one’s account.

Customer Support

For Customer Service, Trading 212 does not provide a dedicated telephone line or chat.

It offers assistance service, active 24 hours a day, 7 days a week, exclusively by email at

We were satisfied with the speed and thoroughness of the replies received for the customer service offered by email, as it is punctual, fast and comprehensive.

We also report the presence of educational materials on the website and a dedicated YouTube channel in which basic trading topics are also discussed in addition to explanatory videos on the functioning of the platform.

Overall Rating

We must say that our opinion of Trading 212 is overall negative.

Various aspects have not left us with a positive outlook, especially regarding the platform, customer service and costs.

The trading platform, while recognizing the great advantage of using a demo version, does not fully satisfy us. The proposed platform is quite sparse and is mainly addressed to users with little to no experience. There are no advanced analysis tools that medium to high-level traders need.

On the trading side, if it is true that, on the one hand, we can trade both real shares and CFDs, on the other hand, we must say that with the Invest account, we have access to a limited number of stock exchanges. If we trade stocks we can only access 7 exchanges, which decreases even more for ETFs, which can be traded on only 4 exchanges.

At the same time, we found high costs for transactions with CFDs.

It almost seems that the offer of trading without commissions on real stocks and ETFs is similar to a honey trap: Trading212 has an interest in encouraging CFD trading among its clients, through which it obtains huge profits from the bid-ask spread and financing costs.

Lastly, let’s talk about customer service. The only assistance service provided is via email which, although fast and efficient, certainly cannot make up for the absence of a direct telephone line or a real-time chat service.

For all these reasons, while recognizing some positive aspects, such as the level of safety offered and the ability to operate on different types of assets, we believe overall that the service offered by Traning212 are not suitable for those who already have a medium to high level of experience.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.

❓ Alternatives to Trading 212

While Trading 212 is a reliable broker, there are better alternatives for trading. For example, if you are interested in trading on the UK or American stock markets, it would be preferable to trade real shares and not CFDs. In this regard, you could consider the online broker DEGIRO, or the online broker eToro.

Why DEGIRO or eToro? First, they are both licensed and regulated brokers. The fees and costs with both are low when compared to those of other online brokers (including Trading 212). Market access is extensive and both real assets and CFDs can be traded. The platforms are designed for both novice investors and advanced traders. With eToro it is also possible to try the demo account with virtual money and copy trading.

Alternatively, if you are still curious about which broker to choose, you can take our test to find out which brokers are most aligned with your investor profile (click here to find your broker).

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.