Summary:

- Both real stocks/ETFs/crypto and CFDs are tradable

- Copy trading functionality

- Investments starting at $10

- Ideal platform for beginners

![]() Pros:

Pros:

- Real stocks/ETFs/crypto available

- Social trading and copy trading experience

- User-friendly platform and mobile app

- Minimum deposit of $50 to start trading

![]() Cons:

Cons:

- No customer service assistance via telephone

- Maximum allowed leverage 1:30

eToro trading review: pros and cons uncovered

eToro is an Israeli online broker founded in 2006. Calling eToro just a broker is, however, an understatement, since it has been one of the leaders of the Fintech revolution. Over the years eToro has helped transform the investment world, bringing social trading to the fore and attracting millions of customers all over the world.

eToro offers a multi-asset platform that allows investments in stocks, ETFs, cryptocurrencies and CFD trading.

In this review, you will find our unbiased and in-depth review of eToro. We have tested the services offered, analyzed the costs and evaluated the platforms and trading tools.

Can trading with eToro be the right choice? Here's what we’ve discovered with our pros and cons revealed.

Safety

When we choose a broker, the first thing we should do - as responsible investors - is to ensure the intermediary's full reliability and transparency. Since it is our savings that are at stake, we would like them to be in the hands of a serious broker.

How does one evaluate the reliability of a broker? We should first make sure that the broker holds a legitimate license and that it is supervised by a rigid regulatory body.

Secondly, we should evaluate the way in which clients' funds and financial instruments are held, especially if a negative scenario occurs (for instance, if the broker defaults).

In this review, we thoroughly analyzed the legal and corporate structure of eToro to determine how safe it is. Here's what you need to know and what our views are on how safe eToro is.

UK traders who intend to open an account with eToro will use its branch eToro (UK) Ltd. It is an investment firm based in London, United Kingdom and through which eToro offers its services to UK clients.

Being based in the United Kingdom, eToro UK is authorized and supervised by the Financial Conduct Authority (FCA) under the license firm reference number (FRN) 583263.

UK-based brokers have the Markets in Financial Instruments Directive (MiFID) 2 directive as the regulatory reference point. MIFID entails a series of obligations, guarantees and transparency from brokers to customers. The latter are therefore offered an adequate level of protection which - in the case of eToro - we can summarize in the following points.

eToro adheres to the Financial Services Compensation Scheme (FSCS). The FSCS is the UK's compensation fund of last resort for customers of authorised financial services firms. It may pay compensation if a firm is unable, or likely to be unable, to pay claims against it. Any money deposited via eToro UK is treated as an investment for the FSCS. Thus, the maximum amount of compensation per person is £85,000.

The Cryptoassets Trading Service applies to any cryptoasset buy transactions made under leverage 1 only, which is a non-regulated service, and when using this service you will not be eligible to apply for and/or receive compensation from the FSCS.

All eToro clients benefit from an additional private insurance policy. This investment insurance policy covers losses suffered due to insolvency, subject to an excess amount. The policy - provided by Lloyd's of London - protects each client up to 1 million GBP. The insurance covers cash, all CFD positions, and securities. Note that cryptoasset positions (non-CFD) are not covered by the insurance, bearing in mind that trading CFD Crypto is not available for UK/FCA users.

Client funds and financial instruments are separate from eToro's assets. This separation allows your assets to remain unattainable by eToro creditors, if, for example, in the unlikely event of the broker’s insolvency. The assets of eToro's customers are preserved by top-tier investment banks.

Each account is protected against a negative balance. It may happen that under certain market conditions, your Available Balance may become negative on your trading account. Upon the occurrence of this event, eToro undertakes absorption of this loss so that the customer cannot lose more than what he has deposited.

Pursuant to the above evaluation, eToro is a broker in possession of sufficient safety requirements and its structure guarantees a high level of protection to customers.

eToro account

eToro offers two types of accounts: a virtual account and a real account.

In both cases, you need to register on the eToro website to use the account. Both natural and legal persons can open an account.

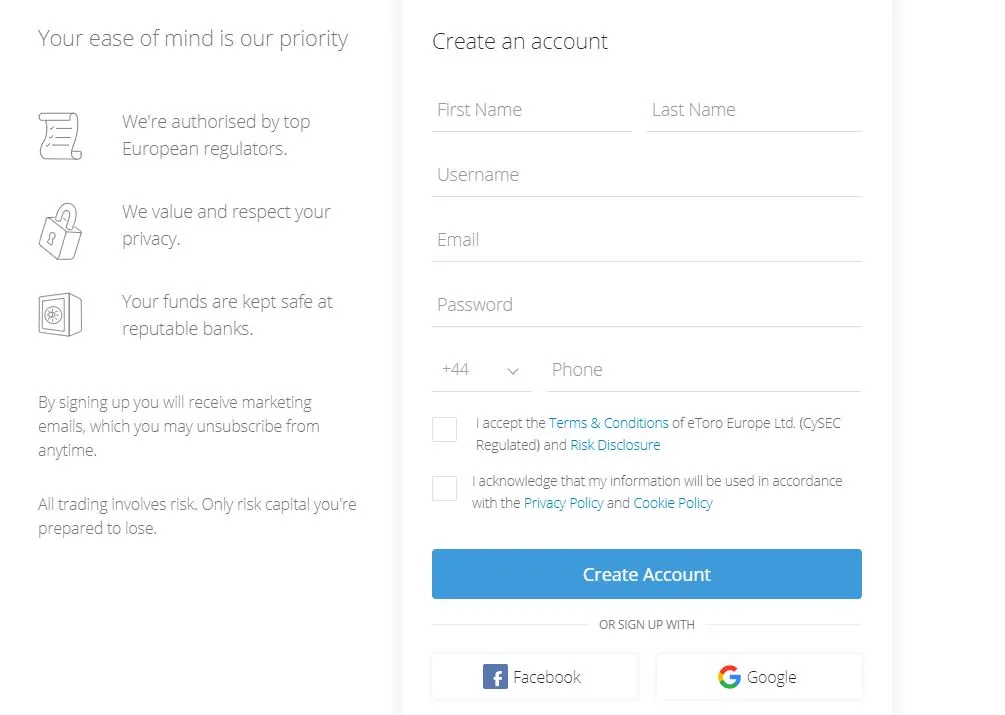

» Account opening

eToro offers a simple and quick process to open an account. To register an account you need to perform the following steps.

Click on Join Now from the eToro website and enter your personal and contact information.

Upload a document of identification and a proof of residence (i.e. a copy of your bank statement or a utility bill from within the past 6 months).

Complete the "Appropriateness Test", in which your financial knowledge will be established.

eToro allows you to complete your account registration within 15 days. Remember, however, that in order to withdraw from the account, the account must be verified. We therefore suggest completing all the required steps immediately, so the first withdrawal takes place efficiently.

» In which currencies can the account be opened?

The eToro account is denominated in USD only. This means that if we deposit pounds, eToro will convert from GBP to USD.

Since this conversion takes place at a higher exchange rate, we suggest you directly deposit USD into your eToro account, in order to avoid conversion costs.

The ideal method is to use a multi-currency card, such as Revolut or TransferWise.

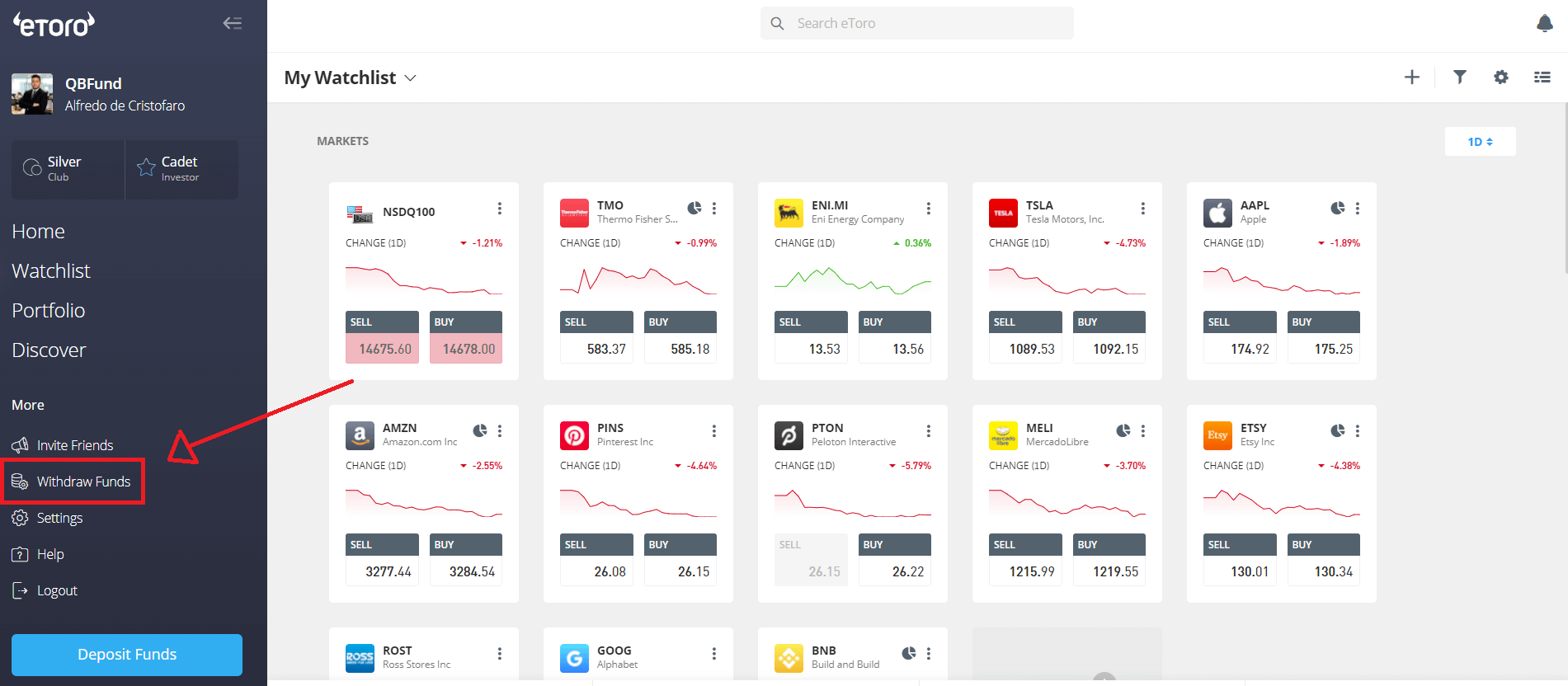

» Deposits / Withdrawals

eToro allows you to deposit and withdraw funds extremely quickly. The accepted payment methods are:

Debit card

Wire transfer

Neteller

Skrill

Sofort

Deposits are credited instantly unless we use a wire transfer. In this case, the funds are usually credited within 1-2 business days.

Withdrawals are processed within 24 hours, but funds will be available on our card or bank account usually within 3-4 business days.

» eToro minimum deposit

The minimum deposit required by eToro is $100.

This amount stands below the industry average since many brokers require a minimum deposit of at least $500.

Products and Markets

eToro was developed as a CFD and Forex broker. Over the years, however, it has been able to listen to customer requests, so as to expand the offer of negotiable securities. To date, using eToro allows you to trade not only CFDs, but also real stocks, ETFs and cryptocurrencies.

Let’s see what assets are negotiable with eToro. These are:

Stocks: more than 2,700 shares available on 17 world stock exchanges.

ETFs: 264 ETFs issued by iShares, Vanguard, PIMCO, SPDR etc.

Indices: 13 world indices negotiable via CFDs. We can find the CFD on DAX and Nasdaq, while the one on the Italian FTSE MIB is missing.

Forex: 49 currency pairs are negotiable: main, minor and exotic.

Commodities: 32 commodities are tradable via CFDs, including oil, gold and gas.

Cryptocurrencies: 62 cryptos tradable including Bitcoin, Ethereum, Ripple, Litecoin etc. In addition, with eToro, you can also trade on the ratio of Crypto with fiat currencies, commodities and other Crypto, such as BTC/EUR, ETH/EUR, ETH/BTC, GOLD/BTC and many others.

Although Indices, Forex and Commodities are tradable exclusively through CFDs, if we look at stocks, ETFs and Cryptocurrencies, these can be traded by purchasing the real underlying asset. How? Whenever you open a long and unleveraged position on stocks or ETFs, eToro delivers the underlying asset to your portfolio (thus not a derivative product such as a CFD).

If, on the other hand, you want to trade stocks or ETFs with leverage or you want to open a short position, the underlying asset is no longer purchased but the CFD.

eToro gives access to the following markets for investing in stocks and ETFs:

- London Stock Exchange

- NYSE

- Nasdaq

- Euronext Amsterdam

- Euronext Paris

- Euronext Lisbon

- Euronext Brussels

- DAX

- Zurich

- Hong Kong

- Borsa Italiana

- Bolsa de Madrid

- Oslo

- Stockholm

- Helsinki

- Copenhagen

- Saudi Arabia

In summary, if you decide to open a long position and with 1x leverage on shares, ETFs or Crypto, you will receive real security. In all other cases, you will trade CFDs.

Choosing real stock/ETF/Crypto is recommended for those with long term investment goals. This way, you will not meet the broker's bid-ask spread and the rollover costs, typical of CFDs.

For those who have more speculative, high-risk high-reward goals and wish to trade in the short term, the use of CFDs will be more in line with this type of objective.

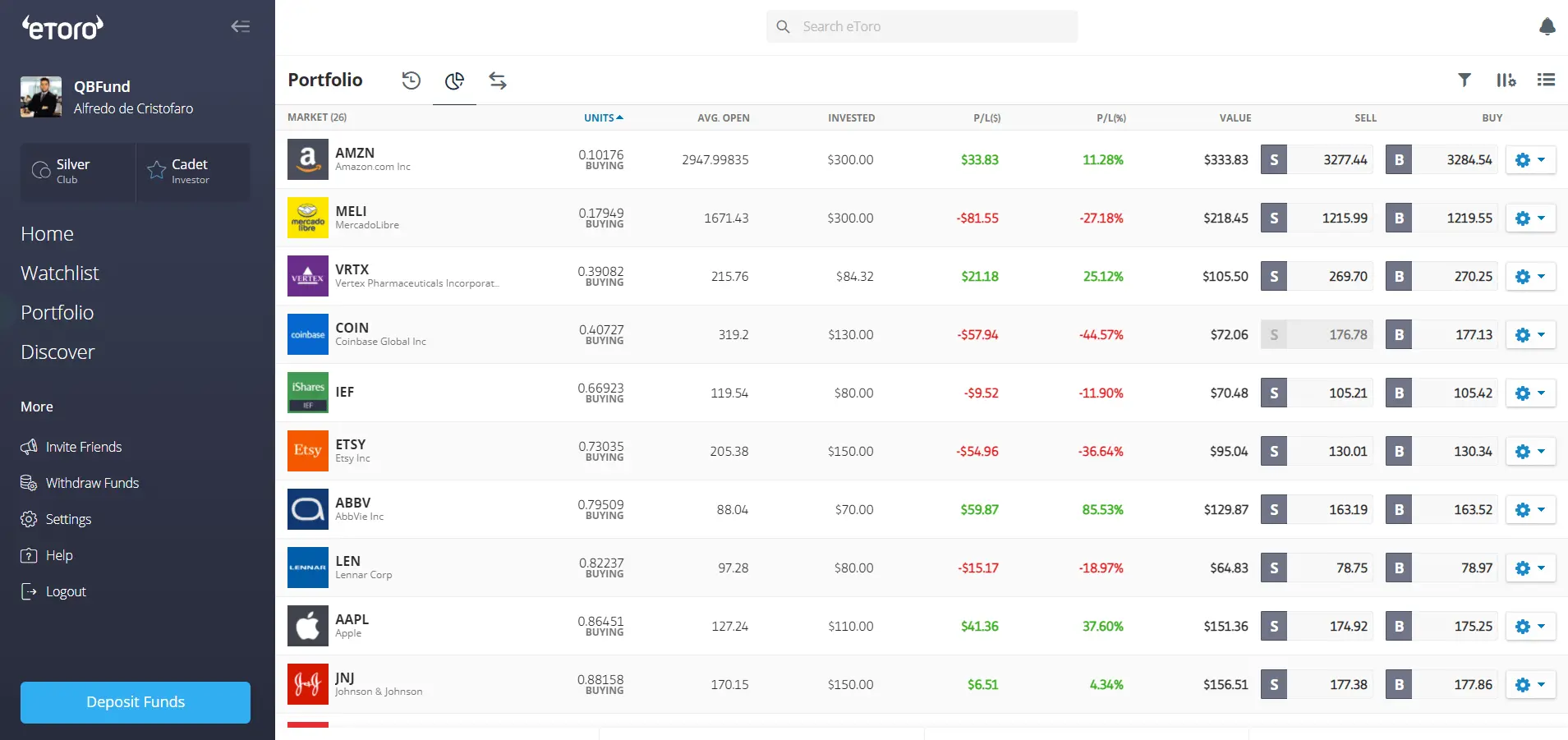

Another important aspect of eToro is allowing fractional share investing.

For example, if I want to invest in Amazon shares, with any other stockbroker I would be forced to purchase a share or multiple shares.

In the case of Amazon, I would need to invest approximately $250 to buy a minimum of one share. With eToro you can buy a fraction of the share, starting at $10. In other words, I will be able to invest any amount I wish, regardless of the price of the underlying share.

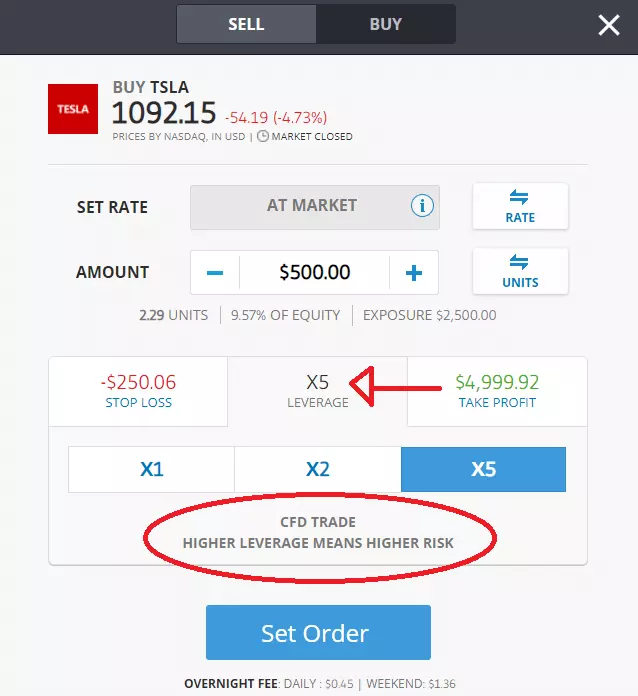

» Financial leverage

eToro UK is a broker based in the United Kingdom. Therefore, it must comply with FCA regulations, which require UK brokers to offer customers maximum leverage of x30.

For eToro, the maximum leverage varies according to the traded asset:

For stocks and ETFs, the maximum leverage is x5

For indices and commodities, the maximum leverage is x20

For Forex the maximum leverage is x30

Trading fees and Costs

How suitable is eToro for trading online? To answer this question, on the one hand, we have to analyze the fee structure, and on the other, we must quantify the costs related to the trading account. Here's what we’ve found out from our analyses and our views on eToro costs.

eToro trading fees

Taking a look at the commissions, i.e. the cost applied by eToro for each trading transaction performed, these vary depending on the product traded.

If you are trading real stock/ETF/crypto (no CFD), eToro is one of the few brokers that offer cheap commissions. This means you will be able to open and close positions paying a small fee.

There are also no additional spreads, rollover or custody costs. In other words, you can buy and sell these financial instruments without incurring costs.

The matter changes if CFDs are used. In this case, eToro applies a spread of 0.09% both for the purchase and the sale. If you hold your position for more than a day, you will also need to consider rollover costs (swap rates).

Considering these fees, it is recommended to trade CFDs only for short term transactions, as to save on overnight CFD costs.

For cryptoassets, eToro applies a fixed spread of 1% on top of the market price (bid-ask spread). The 1% fee applies both when opening and closing a position.

eToro trading costs

Let's now take a look at the costs related to the eToro trading account, i.e. all those costs not deriving from trading transactions.

Opening, maintaining and closing an account with eToro is always free. However, inactivity costs are applied if the account is not used for 12 consecutive months. In this case, a monthly fee of $10 will be charged. To avoid this charge, simply log into your account at least once a month, even without performing any transaction.

Prior to February 19, 2020, the cost for each withdrawal was $25. While deposits are always free, each withdrawal now costs $5. Although the cost of withdrawals has decreased, it is advised to minimize the number of withdrawals, especially those that are not strictly necessary.

Since the eToro account is denominated in dollars, a currency conversion from euro/pounds to dollars will occur if you deposit euros/pounds into the account. The exchange rate used by eToro will be increased by 0.5%. For this reason, it is strongly recommended to deposit dollars directly into the account. The most convenient methods would be to use Revolut or TransferWise.

Example: we deposit 1,000 euros into our eToro account. Since the account is denominated in USD, eToro will convert the amount to dollars. The current EUR/USD exchange rate is 1.0854. while eToro will use an exchange rate increased by 0.5%, that is 1.0854 - 0.005 = 1.0804. Our account will, therefore, be credited with $ 1,080.4 instead of $ 1085.4. The difference between 1085.4 and 1080.4 ($5) is the cost of the conversion.

Trading platforms

One of the pivotal aspects of eToro is its easily accessible trading platform. This is an in-house web platform, i.e. internally developed by eToro, itself.

Being an online platform, nothing has to be installed on a computer nor does it demand specific requirements to function. All one needs is an internet connection. After you have registered an online account, to access the platform you will simply login on to the eToro website.

At first glance, the eToro platform has a modern and clean interface. More than a trading platform, it almost resembles a video game console.

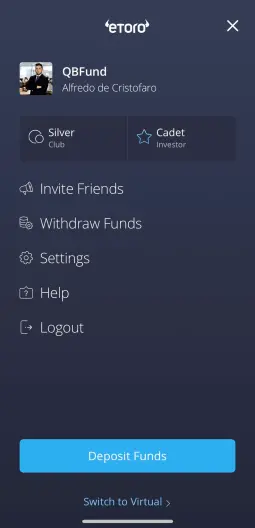

At any time, you can switch from the real account to the virtual account and vice versa. This is an excellent feature as you can carry out test trades and simulations on the demo account at any time.

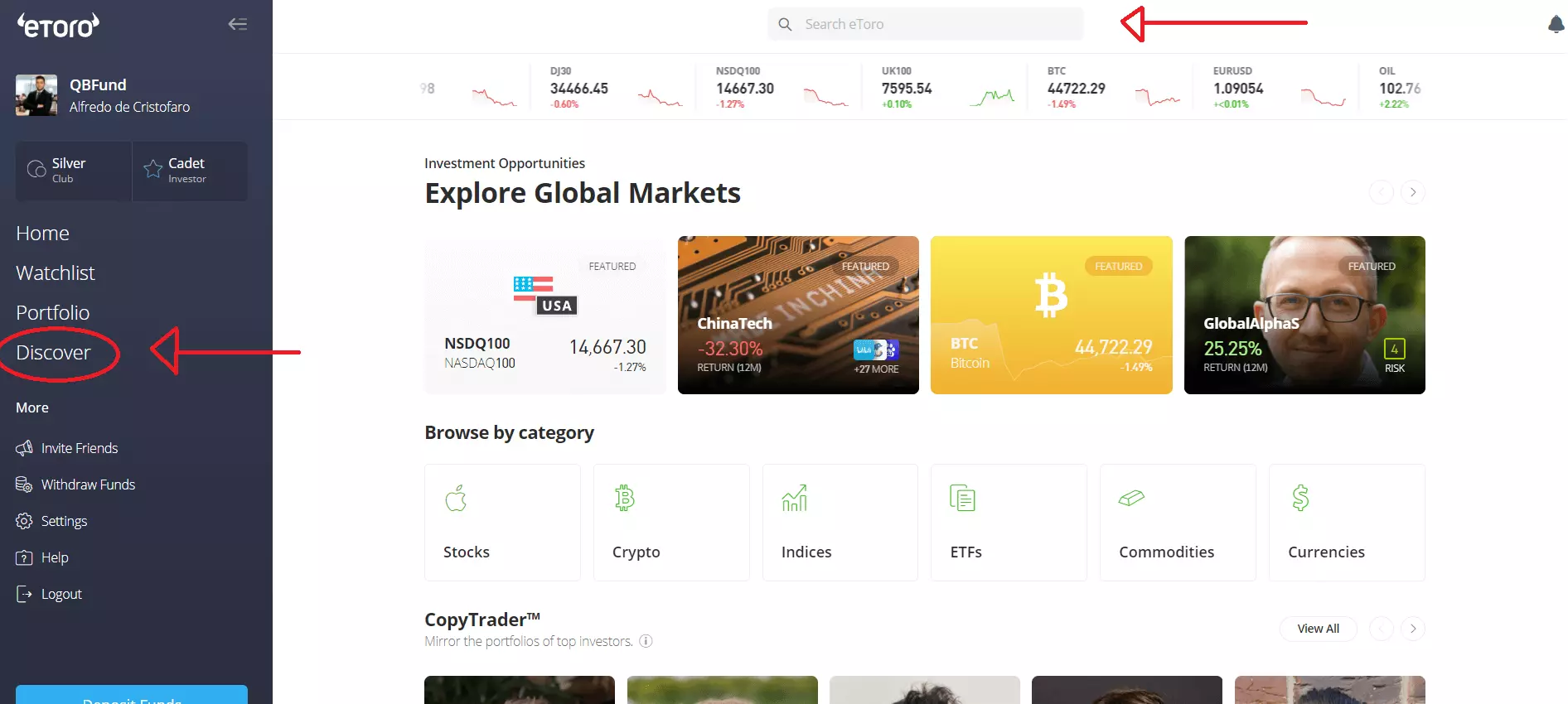

On the left side of the screen, you find the various sections for your account.

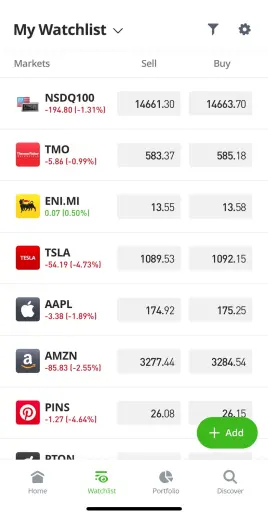

In the Watchlist, you can create your own list with the products of your interest to monitor. From this page, you can also create price alerts and set up one-click trading, by which you can place an order with a simple click of your mouse.

In Portfolio you can find an overview of your portfolio with open positions, transaction history, P&L, etc.

In the News Feed you will find financial and economic news of the day posted by eToro users. This section is reminiscent of the LinkedIn display page.

» Research and analysis

The sections under the Search heading are dedicated to product search.

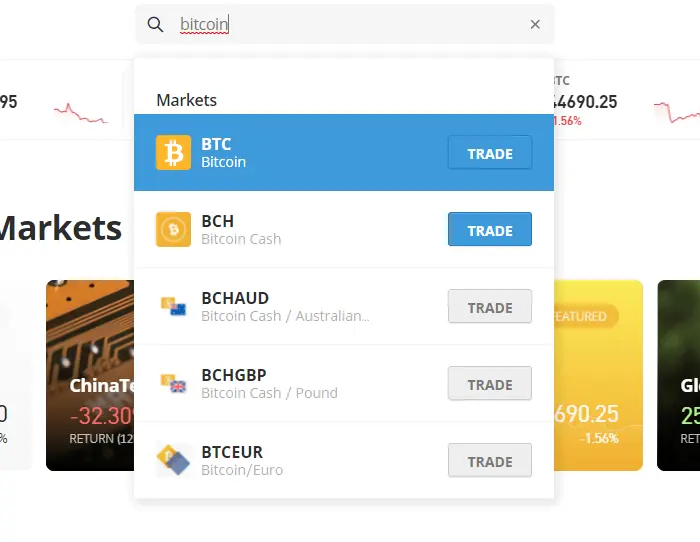

In Trade Markets you will find the lists of negotiable products divided by assets. Alternatively, you can search for any tool from the search engine located at the top of the page.

In the search bar you can search for an instrument by name, ISIN or Ticker. From here, you can also search for a specific trader or a portfolio to copy.

In Copy People and Invest in CopyPortfolios sections you have the ability to search for traders or portfolios to be replicated, as has been discussed in the section titled Social Trading.

Once you click on the product you are interested in, you will be directed to the product tab. Here, you will find the main company information and related news.

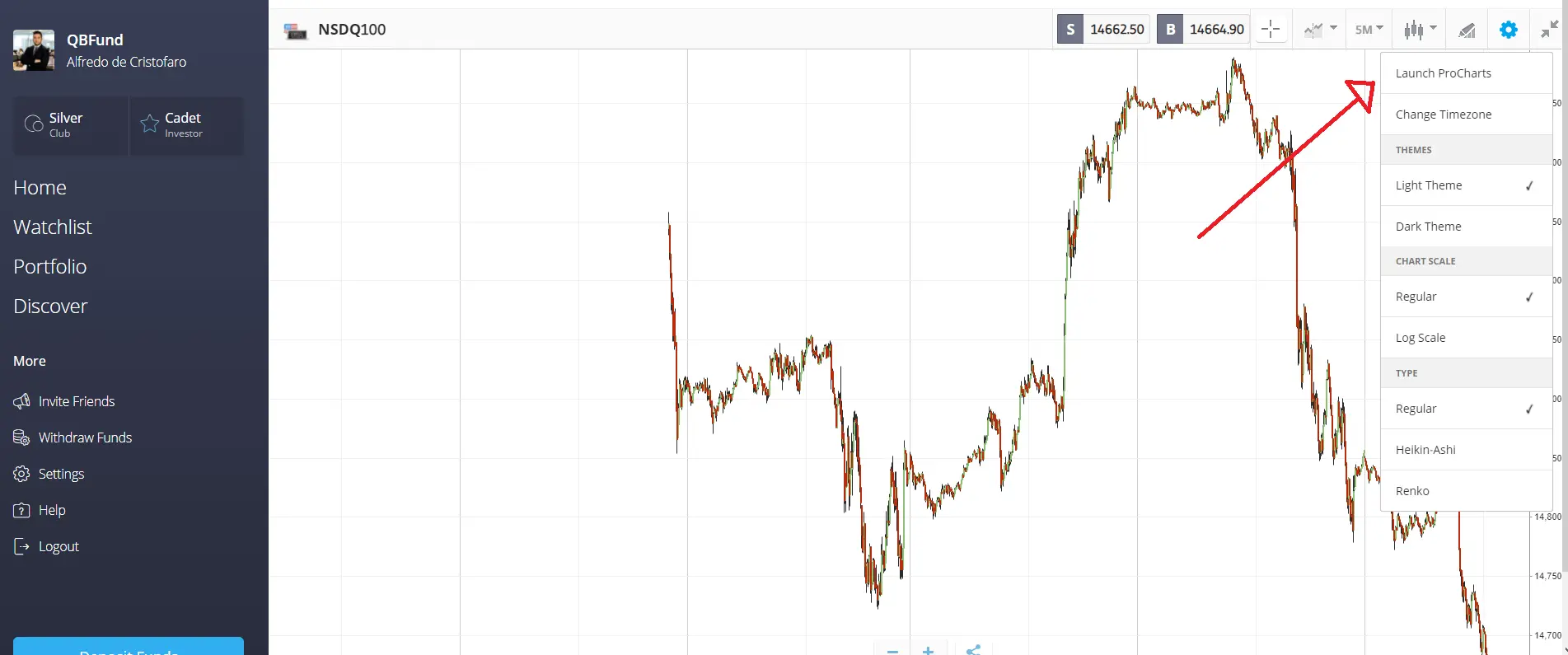

In the next tab you will have access to the product chart. Each financial instrument has its own chart. The standard chart on this screen provides basic information. If you desire a more extensive, detailed chart you will have to launch PROCHARTS.

PROCHARTS allows you to customize the graph and to use a multitude of indicators (67) and geometric tools (13). It also allows you to view multiple graphs on the same screen and save the layout. In PROCHARTS we will therefore find an ideal environment for technical analysis.

Two shortcomings of PROCHARTS are as follows: (1) the inability to enter the order from the chart; and (2) the offering of a book only 1 level deep.

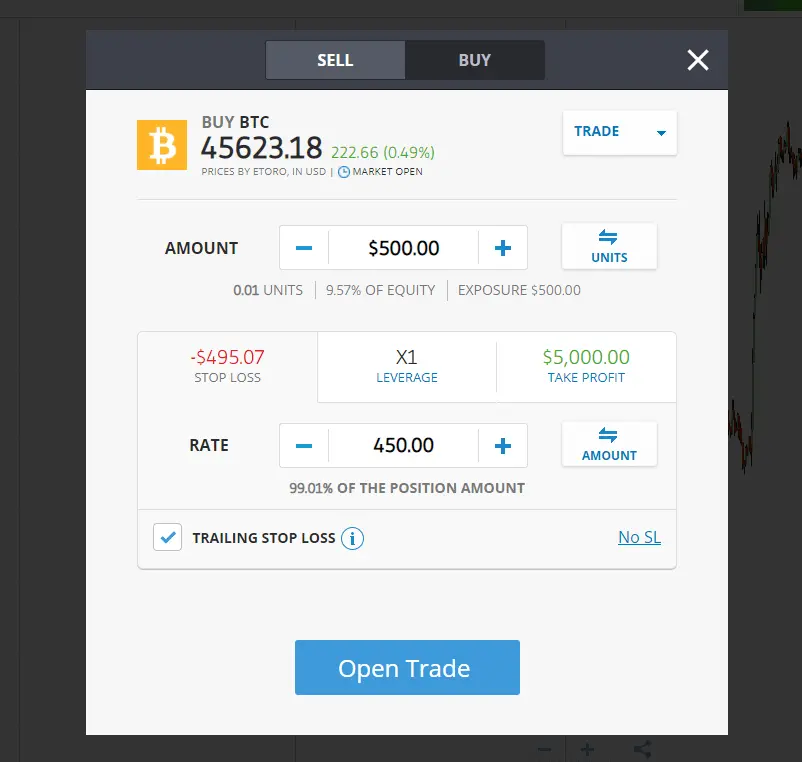

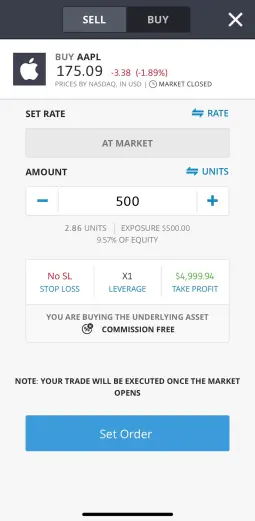

» How to place an order

Entering orders with eToro is very straightforward. Beginner investors can easily learn how to open and close positions immediately, due to the technical terms (typical of the trading platforms) being replaced by understandable terms.

By clicking on the blue button Trade (at the top-right corner) from the product tab, one can open the order entry form.

From this interface you will be able to set:

- The type of order: market or a limit order

- The countervalue or the number of securities to be purchased/sold

- The financial leverage to use

- The stop-loss (or trailing stop) and take profit associated with the main order.

» Two-factor authentication

Two-factor authentication (2FA) allows you to implement an additional level of security to your account. By activating this feature, every time you want to login to eToro you will have to enter a five-digit code eToro will send via SMS.

Two-factor authentication is essential to aid in avoiding third-party access or hacking attempts on your account.

» eToro app

In addition to the web platform, eToro also provides traders with an innovative trading app. The eToro app is available for iOS and Android. The eToro app replicates the features and design of the web platform. During our test phases we discovered the same sections and features of the online website are all present on the app.

The eToro app is limited only in relation to the quality of the charts for the tradable products. For example, approximately 80 indicators and tools are available on the web platform, however there are only five of those indicators and tools found on the app.

Among the available settings on the app, one can set the timeframe of the graph and change the background colour.

Therefore, for those traders who wish to perform a thorough technical analysis, it is recommended they have a PC or laptop, more specifically so they can utilize eToro PROCHARTS.

Tax regime

Since eToro is a UK broker with the headquarters in Israel, for tax purposes it is considered a foreign broker. As a result, the funds and securities held by eToro are considered financial assets held abroad.

Depending on the country in which you are a resident, there will be taxes to be declared and paid. For this matter, we suggest contacting a tax advisor to fulfill all your tax obligations.

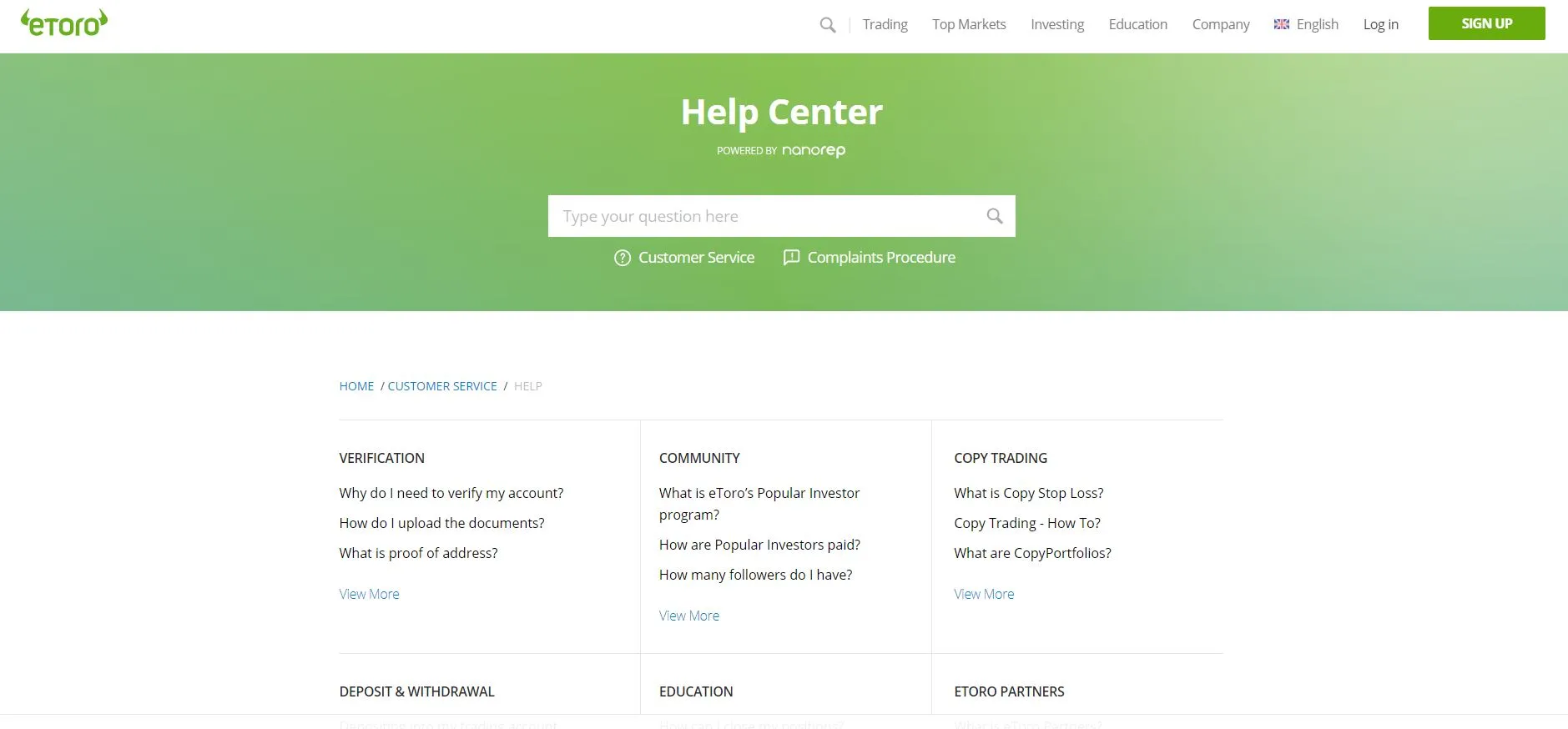

Customer support

Customer support from eToro is overall efficient, although the absence of telephone support could raise eyebrows of some traders.

Customer service is provided through two channels: live chat and support tickets. Both are active 24 hours, Monday to Friday.

Live chat is only available to those who already have an account. Potential customers with questions can submit them to the eToro helpdesk on the eToro website via the ticket service.

eToro also provides a complete and well-organized Help Center on its website. There, you can find answers to your questions by using the customer service support chat, saving the time that would otherwise have been spent contacting support via other routes.

In addition to the Help Center, through the website eToro provides a section dedicated to didactics, titled Education. Here, one can find a series of video tutorials, blog posts, and a series of articles aimed at increasing the level of knowledge of the user.

To date there are no seminars or other live events organized by eToro on the UK territory.

Overall rating

Having reached the end of this eToro review, we can express an overall positive opinion of this broker.

Although not listed on any stock exchange, eToro is a UK-regulated and supervised broker. This allows users to avoid online scams or anomalous behaviours that may cause a loss of invested capital.

The eToro account is designed for the average investor. Its ease of use and the possibility of adopting social trading make it suitable also for those who are beginners in the online trading realm.

The product offering is satisfactory with six negotiable assets. For those who choose to trade stocks and ETFs, trading with competitive commissions can be enticing.

Besides the competitive fees, we should consider other costs such as spreads, overnight costs and conversion costs. For this reason, using eToro for short-term operations is advisable if CFDs are used. On the contrary, shares and ETFs can be held with a long-term time horizon, since these do not present overnight or custody costs.

eToro's online platform and trading app look similar to a social network, where one can access financial news and consult the public portfolios of expert traders. Additionally, from eToro platforms, one can access charts, conduct technical analyses, develop investment strategies, and do much more.

eToro Pros, Cons and Reviews

In light of this analysis, our evaluation of eToro is overall positive. We suggest its use for low fees trading and social trading.

One should be aware of spreads and overnight costs for CFD transactions, as well as be aware of the conversation costs to deposit euros/pounds into your account. In this case, it is preferable to deposit US dollars directly into the account, as to avoid the conversion costs applied by eToro.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What is the next step now?

Open an account with eToro:

Discover the trading tools of QualeBroker:

eToro is one of the most popular online brokers in the world. Founded in 2006, it boasts millions of active customers. Calling eToro just a broker is, however, an understatement, since it has been one of the leaders of the Fintech revolution. Over the years eToro has turned the tables in the investment world, bringing social trading to the fore and attracting millions of customers all over the world.

eToro offers a multi-asset platform who allows investments in stocks, ETFs, cryptocurrencies and CFD trading. You will find all relevant information about eToro in the official review.

Social Trading

eToro is one of the leading players in the brokerage field. The reason is due to eToro being able to differentiate itself from its competitors by offering a plethora of exclusive services. Among these, social trading stands out as a unique method for customers.

Social trading (also called copy trading or mirror trading) stems from a simple idea: copying the operations and strategies of other investors. Once a trader has been chosen to follow, every time he carries out a trade, you will be able to automatically replicate the operation on your account.

» CopyTrader

Within the eToro account you will find a section called CopyTrader. Here you will have access to a list of eToro investors that allow you to follow their strategies and copy their trades.

* Past performance is not an indication of future results

The list of investors is lengthy. Therefore, it is more efficient to utilize the search tool that allows you to filter the results based on certain parameters.

You will have the capability to filter the list based upon past earnings obtained, the risk level of the portfolio, the assets on which traders invest, etc.

* Past performance is not an indication of future results

Why do successful investors make their strategies accessible to other users? These traders join the Popular Investor program, through which traders are rewarded for being copied by other people. Thus, the more they are copied, the more they earn.

As a side note, anyone can become a Popular Investor. You just have to join the program and start promoting your strategy in search of users willing to copy you.

The minimum investment to copy a trader is $200/trade and the operation can be partially closed at any time, simply by removing funds from the copy.

When you copy a trader, it is recommended that you activate the Copy Stop Loss option. It is a real stop-loss by which you set the maximum loss you are willing to bear when copying a trader.

Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

Example: I decide to copy a trader's portfolio by investing $ 1,000. I set an $ 800 Copy Stop Loss. If the trader's portfolio suffers a loss of 20% or more, my position will close with a maximum loss of $ 200.

Start copying top traders →

» Smart Portfolios

Smart Portfolios is the latest generation of investment products. The CopyTrader function allows you to replicate the portfolio of a single investor, while CopyPortfolios provides you with the ability to replicate a group of traders (Top Trader Portfolios) or a basket of underlying assets (Market Portfolios).

Smart Portfolios bring together traders or financial assets within a single portfolio.

The purpose of Smart Portfolios is to create a long-term and well-diversified passive investment instrument. Smart Portfolios are professionally created by the eToro investment committee, which selects both the most deserving traders for the Top Trader Portfolios and the underlying assets to be included in the Market Portfolios.

In many respects, Smart Portfolios resemble Investment Funds.

How do Smart Portfolios work? Although the operation of Smart Portfolios may appear complex, for investors, there are essentially two actions to be carried out:

Copy the best Portfolios →