Summary:

- Partner in Europe of Interactive Brokers

- Quick account opening compared to IBKR

- Efficient and responsive Help Desk

- Trading via IBKR web platform or TWS

![]() Pros:

Pros:

- Fast and paperless account opening

- Commissions on some markets more convenient than those of IBKR

- One of the widest access to global products and markets

- Efficient customer service with a dedicated team

![]() Cons:

Cons:

- Platforms not suitable for beginners

- Money transfers only available via bank transfer

- Limited access to European bond markets

Reviews and insights: online broker MEXEM

In this review, we have analysed and evaluated the online broker MEXEM Ltd, which has recently debuted in the European market. This is one of Interactive Brokers' long-standing partners, for whom MEXEM acts as an introducing broker, first operating in Israel, and then expanding to 24 other countries (including the UK and Europe).

In a nutshell, MEXEM is authorised by Interactive Brokers (henceforth 'IBKR') to collect new clients on the latter's behalf. More accurately, MEXEM offers traders a hybrid account: the user can benefit from IBKR's product and market offerings and the state-of-the-art TWS platform.

At the same time, MEXEM offers a type of account with a more streamlined opening, with different commissions and costs than those applied by IBKR (in some cases, as we will see later, very convenient for UK traders) and with a more attentive and responsive Customer Service to the needs of customers.

Through this offer, MEXEM overcomes some problems that have long been a critical point for IBKR: the opening of a new account too cumbersome; high commissions for some markets; and inefficient Customer Service.

Those who want to trade with IB to take advantage of the brilliant TWS platform and access a large number of products and exchanges will find in MEXEM the best solution for an optimal trading experience.

(no minimum deposit required)

Safety

How safe is it to open an account and trade with MEXEM? MEXEM is an investment firm registered in Cyprus and supervised by CySEC. It is also authorised by the AFM in the Netherlands and the FSMA in Belgium.

However, in order to establish how reliable this broker is, one must look at its partnership with Interactive Brokers. MEXEM acts as an introducing broker on behalf of IBKR: this means that anyone who opens an account through MEXEM's website is entering into a relationship with the American online broker. From a legal point of view, therefore, the user will enjoy all the protections afforded to Interactive Brokers accounts.

These protections are:

- Coverage of up to $500,000 per customer is guaranteed by the Securities Investor Protection Corporation (SIPC) for IBKR US and IBKR UK customers. For IBKR IE and IBKR CE accounts, the coverage on liquidity is €20,000 while the positions are all insured.

In addition to this guarantee, each account is covered by an insurance policy taken out with Lloyd's that indemnifies up to USD 30 million per client. Upon the occurrence of any adverse event at the broker, the broker's clients are protected up to a maximum of USD 30 million. - The segregation of clients' assets from those of the broker. Clients' cash and financial instruments are kept separate from the broker's assets. The custody of funds and securities is entrusted to third-party banks with a high credit rating. In the event of a default of the broker, no third party can claim against the clients' assets.

Just to reinforce the broker's safety and stability, the custodian bank is JP Morgan.

In support of the safety of the MEXEM account, the financial strength of Interactive Brokers should also be emphasised. It is listed on the American Nasdaq exchange (IBKR - US45841N1072), thus all financial statements and financial data are publicly available. Standard & Poor's has assigned IBKR a BBB+ rating with a positive outlook.

Overall, therefore, Interactive Brokers can be described as one of the most reliable and transparent online brokers. By opening an IBKR account through MEXEM, all the safeguards outlined above are preserved, guaranteeing the client the highest standards of safety.

MEXEM account

MEXEM offers only one type of account. To access the services and the platform, an online account must first be registered.

Both natural and legal persons can open an account. Natural persons can choose to have the account jointly.

One of the advantages of the MEXEM account over IBKR is the simplicity of opening an account.

» Account opening

We have already mentioned that MEXEM acts as an Introducing Broker for IBKR. Whereas with the latter opening an account is a long and time-consuming process, with MEXEM the whole procedure can be completed in about 10 minutes.

Opening an account takes place entirely online and is paperless. Once you have entered your data to complete registration, you must upload:

- A valid identity document

- Proof of residence not older than 6 months (a utility bill or bank statement)

The documents are usually approved within 24 hours. If the documents are not suitable, new supplementary documentation will have to be sent. Until the documents are approved, the account will remain inactive.

At this stage, the user is fully supervised by customer service, to speed up the account-opening administrative procedures.

» In which currencies can the account be opened?

UK users opening an account with MEXEM will have GBP as the base currency. The base currency can be changed at any time from the settings.

Within the account, it is then possible to activate the Multicurrency service. With Multicurrency you can convert the base currency into 22 other currencies (USD, GBP, CHF, etc.).

The versatility of having a multicurrency account allows the investor full control of their balances and optimisation of the MEXEM account.

» Account Transfer from IBKR to MEXEM

If you already have an active account with Interactive Brokers you can request a migration of the account to MEXEM. This request can be made from the Personal Area of your IBKR account, under "Account Settings" in the menu.

In case of an account transfer from IBKR to MEXEM, you will keep the same account number and login credentials. In this way, you will be able to benefit from the different fees and rely on MEXEM's customer service.

Below are the steps to link the account:

- IBKR account management login

- Settings → Account Settings

- Click at the top on Link my existing account to an Advisor/Broker

- For IBKR UK:

First field account number: I2078970

Second field: MEXEM LTD

- For IBKR IE (Ireland):

First field account number: I7078970

Second field: MEXEM LTD

- For IBKR CE (Hungary):

First field account number: I7191921

Second field: MEXEM LTD

» Deposits/Withdrawals

Both deposits and withdrawals are made via a single method: bank transfer. Before ordering the transfer via your bank, you must log into your personal MEXEM account area and follow the instructions for the transfer of funds.

Deposits take 24-48 hours to be credited, as well as withdrawals are processed within 48 business hours of the request.

When the account is opened, the investor has 3 months to make the first deposit (of any amount): otherwise, the account will be automatically closed for inactivity and a new one will have to be opened from scratch.

» Virtual account

Once the account is activated, to trade on the real account the user will have to transfer funds by wire transfer. Alternatively, the user can apply to activate the Paper Trading Account. This is a demo account with virtual money ($1,000,000) through which one can access the platform and simulate trading.

The amount of the Paper Trading Account can be reset to simulate a real trading experience as much as possible.

The demo account is certainly useful to start familiarising yourself with the platform and understanding how it works.

Products and Markets

With the MEXEM account, one can benefit from the broad access to markets and financial instruments guaranteed by Interactive Brokers. As far as tradable assets are concerned, these are:

- Stocks

- ETFs

- Bonds

- Indices

- Options

- Futures

- Mutual funds

- Forex

- Commodities

- Warrants

With MEXEM you will have access to 135 markets in 33 countries and in 23 different currencies. In addition to the world's major stock exchanges including those of Europe (including the London Stock Exchange) and North America, with MEXEM you have access to numerous exotic markets (Brazil, Australia, Hong Kong, India, South Africa, Japan) that are difficult to access with most other brokers.

With MEXEM you can trade all derivative instruments listed on the CME, including options on US equities, which are difficult to trade with European brokers.

On the other hand, you will not find bonds listed on the European markets on MEXEM. The only European bonds available are those of Euronext. In contrast, we will find all bonds listed on the American exchanges.

As far as American ETFs are concerned, given the recent legislation affecting all European investors, MEXEM allows you to invest in European ETFs that replicate the performance of Americans.

There are no restrictions if you want to invest in options on American ETFs.

» Financial Leverage

With MEXEM you can take advantage of leverage by activating your margin account, which is available with a minimum liquidity of $2,000.

During the account registration, you will have to choose to activate either the Liquidity or the Margin account. Through the use of margin, the user can trade using only part of the liquidity required to make a purchase.

This is, in short, a real financial overdraft, whereby the broker provides funding to the customer to open positions.

The calculation of the available margin is variable and depends on several factors: the main ones are the risk level of each security and the risk of the portfolio. The latter will determine the maximum margin that can be obtained for opening new positions.

The leverage policy at TWS is based on the investor's safety: for this, the available leverage is balanced with the market.

Furthermore, the margin takes numerous factors into account, not just the individual trade to be opened. For example, if the investor has a bullish market exposure bullish market, selling securities balances the portfolio from risk and consequently the TWS recognises a lower margin.

Fees and costs

As we have seen so far, MEXEM uses the same platform, offers the same access to markets and provides the same level of safety as Interactive Brokers. One area where MEXEM differs from IBKR, however, is in the costs and trading commissions, which justify the excellent and timely customer service.

What are the commissions charged by MEXEM and how much does it cost to maintain an account? As we will see in the next section, the commissions charged by MEXEM are among the lowest in the online trading industry; the MEXEM account has no opening/closing/maintenance fees. From a cost perspective, therefore, MEXEM is undoubtedly one of the most cost-effective brokers currently available to investors in the UK and Europe.

MEXEM trading fees

In order to decide whether to open an IBKR account directly or through MEXEM it will be necessary to make a comparison of commissions between MEXEM and Interactive Brokers. All other things being equal we should choose the cheaper broker.

If we intend to trade on the UK markets, MEXEM is undoubtedly more convenient than Interactive brokers:

- UK stocks have a commission of 0.08% (min. £2.50) with MEXEM, while with IBKR the commission is 0.1% (min. £4.00)

- Options have a commission of €1.80 with MEXEM; €2.00 (€3.00 for index options) with IBKR

- Futures have a commission of € 2.00 with MEXEM; of € 3.00 (€ 2.00 for mini contracts) with IBKR.

If we intend to trade the American stock markets, both MEXEM and IBKR charge a commission of 0.005 USD per share bought/sold. The minimum per order for both is $1.00.

If we want to trade on the European stock markets, with MEXEM the commission varies between 0.06% and 0.08% (with a minimum of € 1.80); with IBKR instead the commissions are much higher (€ 4.00 + 0.01%).

On the commission side, MEXEM offers an even cheaper commission structure than IBKR for the European market, while for the American market, MEXEM charges slightly higher rates than the parent company.

This slight surcharge justifies efficient customer support, with over 200 hours of learning material on TWS reserved for MEXEM clients.

Mexem trading costs

MEXEM offers a zero-fee account. There are no maintenance or custodian fees for securities.

Deposits of funds are always free of charge; each calendar month you can make one free withdrawal (subsequent withdrawals have a cost of €1.00).

Currency conversion takes place for 0.005% of the converted total (with a minimum charge of €5).

On the margin account, daily interest charges are 0.042000%.

Interestingly, it is possible to send orders by telephone at no extra cost. Think, for example, of a situation where we have no access to the Internet and have the urgency to close a position.

Particularly active traders have the possibility of trading commissions with MEXEM. If, for example, you do a lot of futures trading, you can request a downward discount on the commissions shown on the price list. Essential, however, is to have at least 60 days of activity on your account.

Trading platform

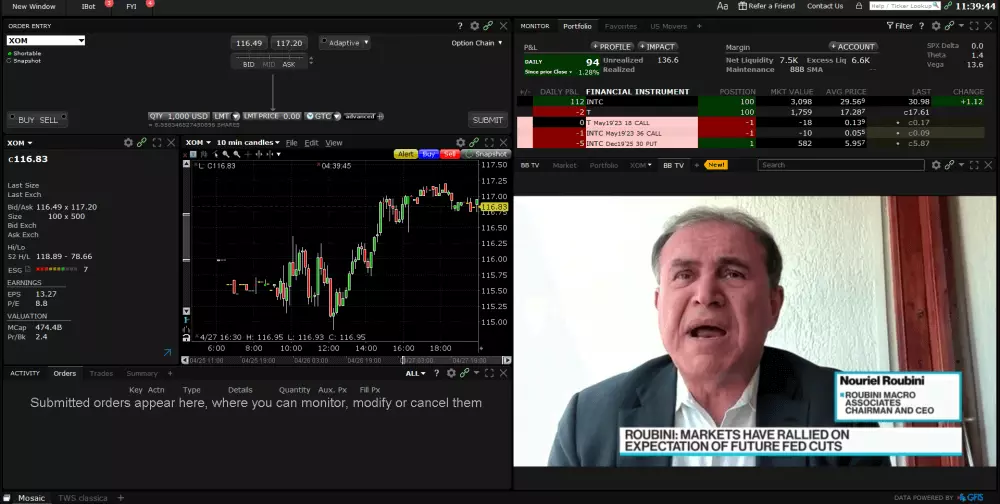

The main platform for trading with MEXEM is the Trader Workstation (TWS) from Interactive Brokers. This is a desktop platform designed for traders with some experience.

In fact, the TWS is a rather complex platform that requires a lot of practice before it can be used, given the multitude of tools and features within it.

For those who are making their first steps with TWS, MEXEM's assistance is essential in order to better understand the software and avoid making mistakes. By choosing MEXEM, you get a multimedia encyclopaedia of PDF guides and video tutorials to help you understand the platform. In addition, MEXEM's assistance can intervene via screen sharing (as well as via email/telephone/live chat) for quick and professional service.

TWS also allows wide margins for customisation, so as to reproduce a trading environment in line with one's preferences. Thus, one can customise the layout, order entry section, product search, etc.

Being a desktop platform, TWS must be installed on one's own computer. It can be downloaded directly from the MEXEM website.

Once the platform is launched, one can decide which layout to use. The default layouts are Classic TWS and Mosaic. From the layout library, you can then load many other layouts depending on what you want to do.

MEXEM also provides its customers with their own customised layouts. This is what it looks like.

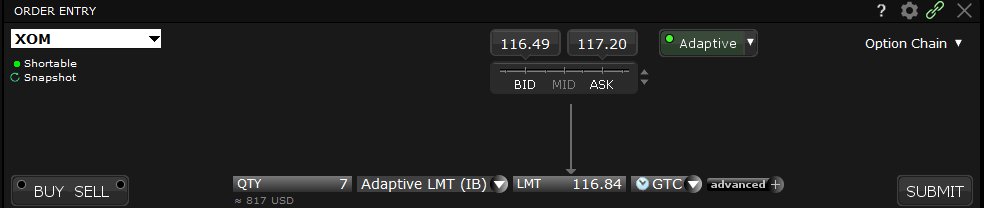

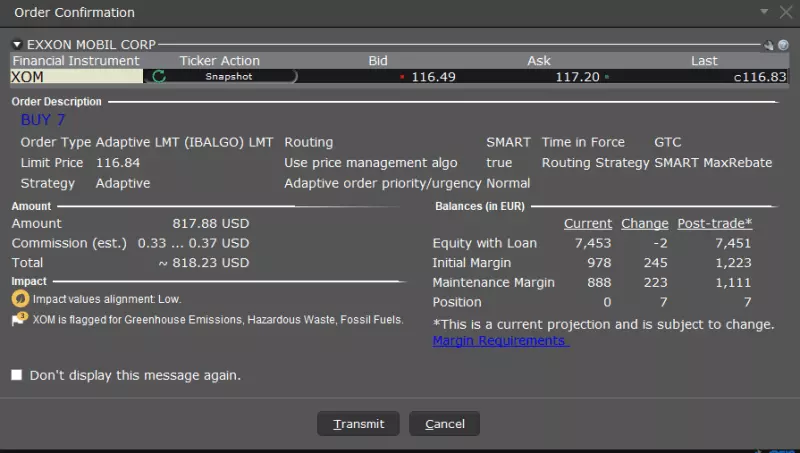

In the top left-hand corner, we find the section for placing orders. This interface is very unintuitive for first-time users. The reason is that TWS allows numerous types of conditional orders to be entered. The main ones are:

- The Market Order

- The limit Order

- The Stop Order

- The limit stop order

- The trailing stop Order

- Adaptive: through the use of an IBKR algorithm that tries to realise the order as quickly as possible and at the best available price.

Secondary orders can then be placed on the main order, such as:

- The stop loss / trailing stop order

- The take profit

- The bracket order (take profit + stop loss)

Before sending the order, the system allows you to see what impact that order will have on our available margin.

Below the order entry section is the chart section. For each chart, we can apply indicators and geometric lines, add the charts of other products to the screen, set price alerts and send the order directly from the chart. For the latter, we can also decide to activate one-click-trading, whereby the order will be placed immediately with a simple click on the chart.

On the right-hand side of the main screen, we then find our Portfolio. In addition to a summary of the various open/closed positions and the P&L, we will find an overview of our margin.

As we have already mentioned, TWS offers traders a multitude of additional tools for product research and analysis. Here are the most interesting ones.

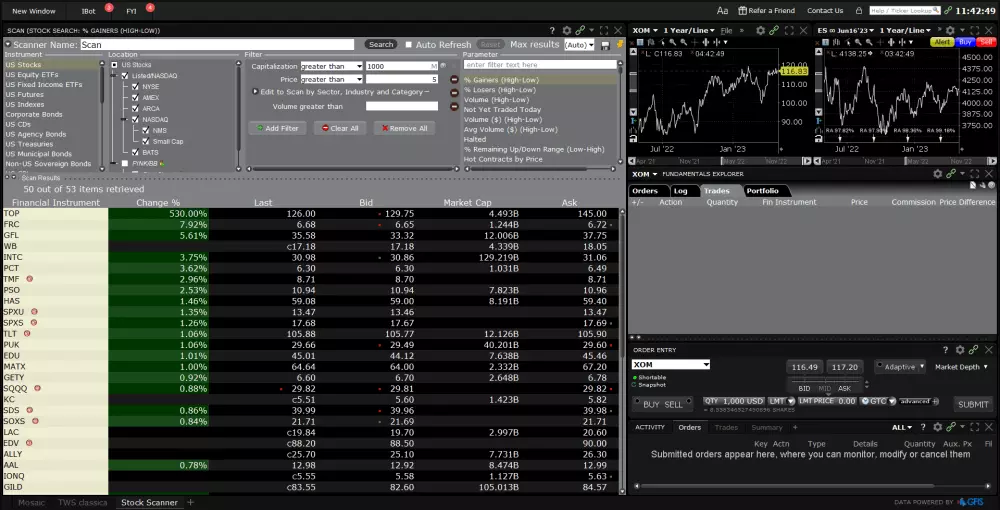

The scanner

Through the scanner, it is possible to scan the various global markets for products that meet certain requirements. We can, for example, start a search by setting parameters for the stocks with the largest daily fluctuations or those with the highest volumes.

Short Stock availability (SLB)

The SLB is a search tool for shortable securities. Through this tool we can find out both the availability of securities that can be sold short and the interest charges (daily and overnight) applied on each short position.

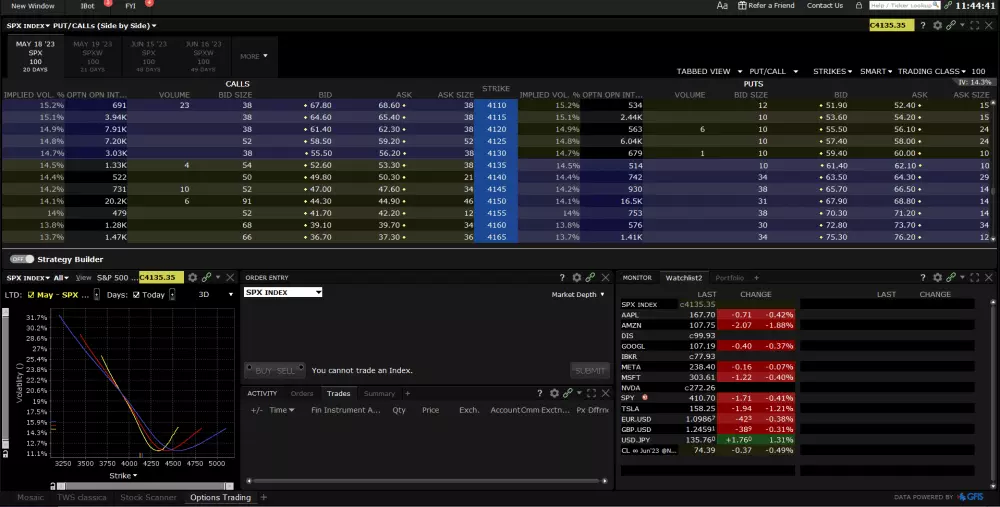

Options trading

The OptionTrader is a trading tool designed for those who trade options. The interface is designed to display option series for any given underlying and to create strategies and order combinations.

Customer service

One of the reasons for opening an Interactive Brokers account through MEXEM lies in the different type of assistance clients receive. When opening an account directly with IBKR, the assistance received from the Customer Service Department will not be satisfactory. Waiting times to get in touch with an operator are quite long (from 30 minutes to 2 hours), often only English-speaking agents are available and the quality of the answers is not always up to the mark.

Customer service represents one of the main weaknesses of Interactive Brokers.

With MEXEM, however, it is the exact opposite! Customer Service reflects one of the strengths of this broker. There is in fact a multilingual team that assists the client in all the steps: from the bureaucratic part in opening and managing the account to the technical assistance on the use of the platform and its customisation.

MEXEM's Customer Service can be reached via email with as many as 3 dedicated channels depending on the request (account opening, assistance in TWS or Customer Area assistance). It can also be contacted via a landline number with a UK area code, a Live Chat service and, for the most sensitive dynamics, a screen-sharing service.

Operators answer from Monday to Friday and waiting times are drastically shorter than in IBKR. In addition, the support service covers a full 11 hours a day, from 8:30 am to 7:30 pm, but soon they will also guarantee coverage in the last 2 hours of the American evening time slot.

The MEXEM team has over 10 years of experience on TWS.

So if you are a trader who would like to rely on efficient and timely Customer Service at all times, our recommendation is to open an IBKR account through MEXEM.

Final verdict

The MEXEM account is an ideal solution for those who wish to trade with Interactive Brokers but are held back by some of the latter's typical problems: complex account opening, high commissions for some markets (e.g. the UK market), and inefficient customer support.

MEXEM succeeds in overcoming these critical issues while preserving IBKR's strengths. By opening a MEXEM account one can in fact use the excellent proprietary TWS platform, and benefit from the wide access to products and exchanges and the main services offered by IBKR (Multicurrency service, short-selling, margining etc.).

At the same time, MEXEM offers some solutions that enhance the trading experience compared to opening an IBKR account directly:

Opening an account is quick and easy.

Commissions on European markets are cheaper.

Customer service is attentive and timely, unlike IBKR's which can be described as inefficient.

In conclusion, in our opinion, MEXEM is the best choice to open an Interactive Brokers account and we recommend it to users looking for a broker with an advanced platform and advanced services.

(no minimum deposit required)

What is the next step now?

Open an account with MEXEM:

Discover the trading tools of QualeBroker: