Summary:

- Five types of accounts available

- User-friendly trading app

- Trading on shares, ETFs, cryptocurrencies and commodities

- Investments from £1

![]() Pros:

Pros:

- Wide range of financial products and services

- User-friendly mobile app

- Overall low costs and fees

- Trading platform suitable for beginners

![]() Cons:

Cons:

- Limited number of negotiable shares

- It's not possible to transfer and receive cryptocurrencies

- No telephone customer service assistance

- Limits on free ATM withdrawals

Revolut is a bank-licensed company established in the UK. It has no branches and its services are provided entirely online, through the Revolut app. What does the Revolut app allow you to do?

You will find all the relevant information about Revolut within this official review.

Reviews and Opinions: Revolut checking and trading account

It is now well known that the future of the banking sector is online. Today, thanks to the power of home banking, it is possible to carry out financial transactions directly from our smartphone or PC, without having to physically enter a bank.

In recent years, banks that operate only online have become increasingly popular.

Among the various online institutions, is one of the most important, innovative and functional: Revolut.

Revolut LTD is a UK based financial company founded in 2015 and its product, the Revolut app, boasts more than 35 million private customers and over 500,000 business customers.

The advantages over traditional accounts are various and clear, especially in terms of management and/or administrative costs: commissions which "normal banks" cannot compete with.

As for the functions and services offered, the Revolut app proves to be a strong suited option, as it offers:

- A currency exchange, a tool that allows you to convert GBP into over 150 different currencies

- The possibility to buy shares with commissions starting from 1 GBP

- Trading and holding of cryptocurrencies

- The Vaults

- Insurance products

Safety

Online banking and security are two topics that need to be closely aligned. In recent years, many accounts have been breached through phishing and ransomware attacks, both due to vulnerabilities in the protection systems of the banks themselves, and/or through incorrect actions by account holders.

Revolut, a company with over 7,500 employees, has a team dedicated exclusively to security that works every day to improve the efficiency of protection services such as:

- Fingerprint identification, necessary to access the account and confirm operations

- Sherlock anti-fraud security system to send real-time alerts on fraudulent activities thanks to localization systems. If Revolut perceives suspicious activities (e.g. the location of your smartphone indicates London but a payment is made in Bristol) it blocks it and immediately notifies the customer

- The ability to create disposable virtual cards and customized features for spending limits, withdrawals, online and/or swipe payments.

Account Types

Revolut offers five types of checking accounts, each with different features.

» Standard Account

The Standard Account is the basic version of the Revolut account. It is free, allows you to make bank transfers at zero commissions, as well as exchange pounds to other foreign currencies at the best exchange rate and without paying commissions (up to a maximum of £1,000 per month, beyond this threshold a commission of 1.00% is applied).

The Standard Account also gives the option of a debit card with which allows to make payments both online and in store as well as withdraw up to £200 per month for free (max 5 withdrawals) from any ATM (beyond this amount, a 2% commission is applied).

With the Standard Account it is also possible to trade stocks and ETFs (first trade of the month is free, then 0.25%) and cryptocurrencies.

For conversions of fiat currencies into cryptocurrencies the commission is 1.49% (min. £1).

» Plus Account

The Plus Account is the first upgrade to the Standard account. It has a monthly fee of £3.99 and it offers additional services than the Standard account.

It offers a 24/7 priority assistance service, refunds of up to £1,000 for the purchase of tickets for events, refunds on purchases of items up to £1,000 in the event of theft or accidentally damaged product and the ability to be refunded if you purchase products for which the retailer does not accept the return (coverage between £50 and £300).

Debit card delivery is free and it is possible to trade stocks and ETFs (the first three trades per month are free, then 0.25%) and cryptocurrencies.

For conversions of fiat currency into cryptocurrencies the commission is 1.49% (min. £1).

» Premium Account

The Premium Account has a monthly fee of £9.99 and provides, in addition to all the features of the two previous accounts (Standard and Plus Accounts), the possibility of requesting two debit cards.

With these cards you can make online and in-store purchases, as well as withdraw up to £400 per month for free (beyond this amount, a 2% commission is applied).

The Premium Account also allows you to create disposable cards to be used one or more times for online purchases.

Other services include the right to priority assistance from customer service, international medical insurance, insurance coverage for flight and baggage delays and an airport lounge pass. For stock trading, 8 free trades per month are included.

For stock trading, 5 free trades per month are included. Then the commission is 0.25%.

For fiat currency to cryptocurrency conversions the commission is 0.99%.

» Metal Account

The Metal Account is a further upgrade of the Revolut account. It has a monthly fee of £15.99 and in addition to all the features of the previous plans, it entitles you to request three debit cards with which you can:

- Shop online and in stores

- Withdraw up to £800 per month for free (beyond this amount, a 2% commission is applied)

- Have a concierge to better manage bookings on flights, hotels and events

- Have the Metal Cashback which allows you to receive a refund of 0.1% of purchases made in Europe with each purchase, up to a maximum of 1% for payments outside the EU.

For stock trading, 10 free trades per month are included. Then the commission is 0.25%.

For fiat currency to cryptocurrency conversions the commission is 0.99%.

» Ultra Account

The Ultra Account is the maximum upgrade of the Revolut account. It has a monthly fee of £45 and offers additional benefits and features. It entitles you to a platinum-plated debit card with which you can:

- Make purchases online and at stores

- Withdraw up to €2,000 per month free of charge (above this amount a 2% fee is charged)

- Up to €5,000 allowance to cancel plane, train, flight, hotel and event bookings

- Ultra Cashback which allows you to receive 0.1% cashback on every purchase made within Europe, up to a maximum of 1% for non-EU payments.

- Up to 10% cashback on accommodation with Revolut Stays

For stock trading there are 10 free trades per month. Then the commission is 0.12%.

For fiat currency to cryptocurrency conversions the commission is 0.49%.

Products and Markets

To date, Revolut allows trading on over:

- 150 fiat currencies

- around 2,000 different stocks listed on the NYSE and NASDAQ and around 70 European equities

- More than 150 European ETFs

- 4 commodities: Gold, Silver, Palladium and Platinum

The possibility of fractional purchases on equities and ETFs should be highlighted. It is possible to buy shares for as little as USD 1.

Revolut strives to continuously add new financial products to be traded on the app. Revolut promises to increase the number of European equities that can be traded on the platform.

How are orders placed on the stock markets?

Revolut is not a DMA broker (i.e. it does not have a license for direct access to the markets). Rather, it uses third party brokers to allow its clients to place orders on the stock exchange. We confirm that Revolut allows the trading of real shares/ETFs and not of CFDs.

We also wish to point out that Revolut offers free quotes for negotiable securities, without a user having to pay a monthly fee, as is the case with most online brokers.

120 cryptocurrencies are also tradable on Revolut, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- Bitcoin Cash (BCH)

- Litecoin (LTC)

It is possible to send cryptocurrencies to friends (ie other Revolut users) by accessing the service through the appropriate "Payments" tab. However, it is not possible to transfer crypto outside the Revolut platform, but the wallet functionality will be included in the future.

Fees and Costs

As mentioned above, one of Revolut's strengths is represented by the absence of commissions for functions such as wire transfers, debit card payments (both in the UK and abroad), withdrawals (up to a certain limit, which varies depending on the type of plan selected), sending money to friends and/or acquaintances who are Revolut customers.

As for the currency exchange function, which allows us to convert our funds into more than 150 different currencies, it is always free of charge for Premium, Metal and Ultra accounts; for Standard and Plus accounts, however, only the first £1,000 (Standard) and £3,000 (Plus) converted each month are free of charge.

For conversions of fiat currencies into cryptocurrencies, a fixed fee of 1.49% (min. £1) is charged for Standard and Plus users; 0.99% for Premium and Metal users; and 0.49% for Ultra users.

The VAULT functions are free and allow you to store fiat currencies or cryptocurrencies.

Finally, with regard to stock trading (Revolut also acts as an online broker), the commission charged depends on the type of account. Specifically:

- Standard account: 0.25% and one transaction per month for free

- Plus account: 0.25% and three transactions per month for free

- Premium Account: 0.25% and five transactions per month for free

- Metal Account: 0.25% and ten transactions per month free

- Ultra Account: 0.12% and ten transactions per month for free

Note that with Revolut you also pay 0.12% per year on the assets held in your portfolio for custody fees. This custody fee makes Revolut not very convenient for trading in general in comparison to other online brokers.

Promotions

These are the promotions currently running with Revolut:

- Partner sites where Revolut customers can get discounts or coupons

- Invite a friend and for each invited friend you will receive between £30 and £60 depending on the value of the current promotion.

- Users who have a Metal or Ultra card and make purchases with it benefit from a cashback of 0.1% in the UK and Europe, and 1% out of Europe.

Platform

The Revolut app is intuitive and user friendly. Executing transactions is simple, for payments and transfers, as well as for trading and/or currency exchanges.

From the main page, the menu is divided into 5 categories. Let's review them in detail.

» Accounts

From the Accounts section you can:

- View the report of the latest operations carried out

- Add funds via credit cards

- Convert your currency into other currencies (for all customers) or crypto (only for Premium and Metal users)

- View the details of accounts such as nominee, Iban, BIC / SWIFT

- Generate customized account statements (daily, weekly, monthly, yearly, etc.)

» Analytics

In the Analytics section you can see in detail all the expenses made divided by categories.

» Payments

From the Payments section you can send or request money to friends and acquaintances, make bank transfers or schedule future payments.

There is also the "Around me" feature that allows you to send money to people near you via GPS tracking and the ability to create payment links to send money online.

» Cards

From the Cards section, you can view the details of your Revolut debit cards and change your limit and security settings.

» Dashboard

From the Dashboard, you can view the general status of your fiat and crypto accounts, view your equity portfolio and your personal watchlist with your favourite stocks.

From this section, you can also change the settings related to the app, request assistance from customer service, change your rate plan, view the details of insurance coverage and use the concierge.

»Trading Stocks, Forex and Cryptocurrencies

Trading on the Revolut app is very straightforward. The platform is dedicated to non-professional private clients, so no advanced features are available. However, the convenience of being able to carry out all operations from a single application is significant and allows a user to save a lot of time.

Converting your GBP into other fiat currencies or cryptocurrencies is very simple. Just find the Accounts section, press the Exchange button and select the currency you want to convert and the one you want to receive.

To trade shares, go to the Dashboard section and select Stocks.

After accepting the terms and conditions of the service, Revolut will open an account dedicated exclusively to the trading of shares.

After funding your account, you will be able to buy shares by choosing from a wide range of products on the platform.

After selecting the company you want to buy shares from, just click the Buy button to carry out the first transaction.

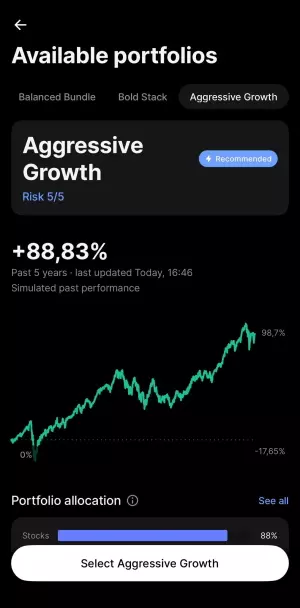

» Robo-Advisor

The Revolut Robo-Advisor is an automatic investing option: the money is managed by a real virtual advisor. Thus, it is a mathematical algorithm (robot) that chooses the investment, independently and according to user-defined parameters.

How does it work? The functioning is simple. Simply select Robo-Advisor from the Revolut dashboard. You will then create a diversified securities portfolio, consisting of between 5 and 6 ETFs. The process is intuitive and accessible to all investors. The steps are as follows:

- Choose your portfolio target: e.g. capital accumulation, inflation protection, savings for a purchase, retirement, etc.

- Indicates your risk tolerance: low, medium or high

- Set the time horizon: more than 10 years, 5-10 years, 2-5 years, up to 2 years

- Enter the starting investment: the minimum amount starts from 100€

- Indicates recurring deposit: this is a customisable value

Once these questions have been answered, the Robo-Advisor will suggest the most suitable portfolio for you, selecting ETFs with a basket of securities consisting of stocks, bonds or other assets, based precisely on the parameters indicated. It is the Robo-Advisor that manages where to invest subsequent deposits, to reach the set goal in the shortest period.

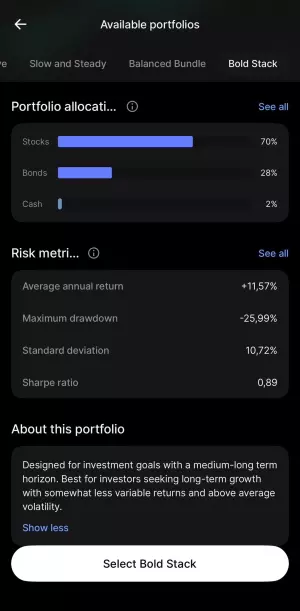

Based on the answers entered during the profiling steps, you will be suggested one of the five portfolios currently available, which in order from most protective to most aggressive are:

- Defensive

- Slow and Steady

- Balanced Bundle

- Bold Stack

- Aggressive Growth

Robo-Advisor Revolut costs

There is no monthly fee, but a 0.75% commission is charged on the annual amount invested, with payment deferred over 12 months. You can release the funds at any time: within 4 days they will be in your account, without penalty.

Robo-Advisor Revolut pros and cons

The Robo-Advisor offered by Revolut could be useful for those who want to invest but have no financial knowledge or time to commit to the markets. Returns are not high, except if the risk index is increased. Moreover, constant monitoring of one's investment is required.

Customer Support

Revolut customer service is available 24/7 via Live Chat only. To contact support, go to the Dashboard section and click on the Chat button at the top right of the screen.

You are automatically connected to the interactive system, which meets most users’ needs.

Waiting times are very short, usually you get an answer within 2 minutes. In the event you need to freeze credit cards, you must call +442033228352.

Education

For learning opportunities, the Revolut blog has been released, which is an informative portal where you can find informational articles about the world of finance. In addition, you can find Revolut Academy, a section entirely dedicated to the education of Revolut and non-Revolut users, including various topics such as finance, IT security and cryptocurrencies.

Overall rating

At the end of this review, we can conclude that Revolut fully lives up to expectations. Today, Revolut is a more than viable alternative to traditional bank accounts, indeed superior in many respects, especially when it comes to modernity and security.

Revolut is practical for both managing your own money and for building a portfolio of stocks, ETFs, cryptocurrencies and commodities.

Designed for both experienced and novice users, Revolut makes managing financial assets very simple and straightforward. Opening an online account with Revolut can therefore be convenient for those who want to start investing their savings.

❓ Alternatives to Revolut

While Revolut is at the forefront of offering banking products and payment solutions, from the point of view of investing it is not yet a broker to consider. The product offering is limited and the trading environment is still "primitive". If you are looking for a platform to invest in global stocks, indices, cryptocurrencies etc. or to copy other professional traders (copy-trading) we suggest you try eToro (click here to sign up for free on eToro).

51% of retail investor accounts lose money.