Summary:

- 2 types of account available

- Stocks, ETFs, bonds and options are tradable

- D-account Securities Swap with 2,69% (EUR) and 4,35% (USD)

- Long-Term Funds Placement Securities Swap up to 7.16%

![]() Pros:

Pros:

- Company listed on NASDAQ and authorised in Europe

- Zero account opening, maintenance and closing costs

- D-account Securities Swap returns of 2.63% (EUR) and 4.34% (USD)

- Deposits and withdrawals also by credit card

![]() Cons:

Cons:

- UK residents not accepted

- 18% margin trading fees

Freedom24: what is it and how does it work?

In this review, we have tested and analyzed Freedom24, a new online broker that has recently debuted in the European landscape. Freedom24 is not a broker similar to other investing brands. It is true that, like many of its competitors, it allows you to trade shares, ETFs, bonds and derivatives. However, Freedom24’s range of services goes beyond the competition.

We can affirm that Freedom24 plays a crucial role in the ongoing process of the democratization of finance, where investing is within everyone's reach and without barriers as in the past.

Another service offered by Freedom24 is the D-account Securities Swap. This Securities Swap (denominated in EUR or USD) offers fixed returns up to 5,32% per annum.

In the next sections of this review, we will examine the topics briefly mentioned so far in more detail. We will see what Freedom24 is and to whom it is aimed, what investment services it offers and which platforms it makes available for its users.

In the final paragraph, you will find our opinions on Freedom24, which will help you understand if this broker may be the right choice for you to invest.

Who is Freedom24 for?

Freedom24 is an online broker that allows you to access the main global markets to buy and sell financial instruments. A Freedom24 account is ideal for anyone who wants to:

- Trade on stocks, ETFs, bonds, futures and options listed on regulated markets

- Get a fixed return in EUR or USD through the investment in Securities Swap

- Invest with minimal capital

The Freedom24 account is, therefore, aimed at investors who intend to invest independently. The latter will have to determine how and where to invest; Freedom24 will simply provide cutting-edge tools to do so.

Given the degressive fee structure, users who invest large capital will be able to receive a reduction on the commissions of stocks and ETFs against a fixed monthly fee. Those wishing to invest with low capital will start from the lowest commission band, which is still quite affordable ($/€ 0.02 for each share or ETF traded) when compared to the fees charged by the main brokers in Europe.

Why choose Freedom24 over another broker?

- No minimum deposit is required to start trading

- The platform is simple to use and requires no high-level skills

Safety

Freedom Holding Corp. serves its European clients through the Freedom Finance Europe Ltd. branch. It is supervised by three regulatory bodies: CySEC (Cyprus), BaFin (Germany) and SEC (United States).

Freedom Finance Europe Ltd is based in Limassol, Cyprus. Therefore, it falls under the European Union MiFID II regulation for the regulation of financial markets.

Below is the note on the broker's website: "Freedom Finance Ltd provides financial services in the European Union by the CIF 275/15 license for all types of business required by companies, granted by the Cyprus Securities and Exchange Commission (CySEC) on 20.05.2015 ".

Given that Freedom24 is based in the European Union, European investors can benefit from important protections for the investor provided for by European legislation, namely:

- The European deposit guarantee scheme, e. a guaranteed coverage to traders equal to an indemnity of up to €20,000 (in cash or financial instruments) if the broker is unable to return them to users in person (for example, in a case of default)

- The segregation of funds: the separation of user funds from those of the broker so that, in the event of failure of the trading platform, no creditor of the broker will have the option to claim back funds deposited by users

- Negative balance protection: this protection allows users to avoid generating a loss on their account that exceeds the cash balance (i.e. the total amount of money paid into the account)

Since October 2019, Freedom24 has been listed on the NASDAQ under the ticker FRHC.

The security has a Standard & Poor's rating equal to B, that is, with a significant speculative characteristic and an issuer able to meet its financial obligations, albeit with uncertainties that could affect its financial commitment.

Freedom24 Account

Freedom24 offers two types of account:

Smart account in EUR: 0€ monthly fee and no transaction discounts

All inclusive in USD: 0€ monthly fee and intermediate transaction discounts

In addition, Freedom24 offers clients the possibility of opening a D-account Securities Swap, denominated in EUR and USD, to invest their money with fixed returns of up to 4.27% p.a. and with the return calculated daily.

How to Bind Funds? Placing Long-Term Securities Swap is a simple operation: in your Personal Area, go to the section Placing long-term funds.

Here you will have to choose the duration of the placement (3, 6 or 12 months) and the amount to be bound.

Once the operation is confirmed, the investment is active.

At maturity, you will receive back the initial capital and the income generated.

If, on the other hand, you wish to take advantage of the D-account Securities Swap, i.e. with daily income accrual and no constraints, you will have to make an internal transfer from the main account to the D-account Securities Swap. Once you have transferred the sums to this subaccount, you will begin to generate a daily fixed return that will be paid out to you monthly.

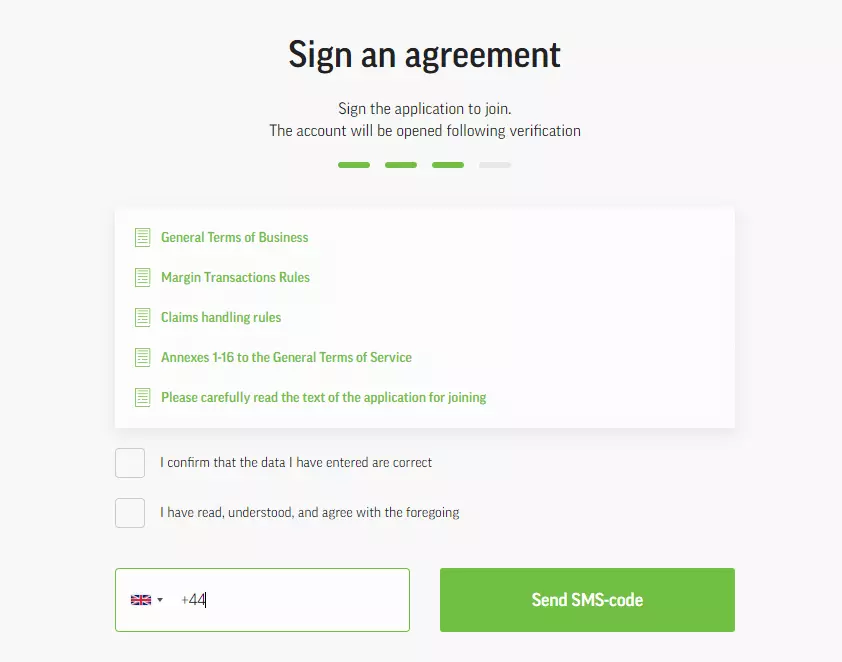

» Account Opening

Opening an account on Freedom24 takes place entirely online and consists of the following steps:

1. Click on the Registration button at the top right of the menu and enter your data

2. Upload a scanned copy of an identification document as well as a document showing your residential address, plus the taxpayer number in the country where you have your tax residence.

Furthermore, the user will be given a risk tolerance survey questionnaire to define their investor profile, with questions related to the investment time horizon, investment objectives, knowledge and experience with various financial instruments, savings capacity, etc. The questionnaire complies with Mifid II regulations for the regulation of financial markets to protect investors.

The duration of the registration process for a Freedom24 account is approximately 10-15 minutes, at the end of which the platform will make a personal Private Area available to the user and he will be contacted by email with all the necessary information.

While the account opening is being formalized, the user can access the platform through a virtual account, using the credentials created in the registration phase for login.

» Which countries does Freedom24 accept?

Freedom24 accepts those with an EU residence permit as clients. It therefore means that UK residents cannot open a Freedom24 account.

» In which currencies can the account be opened?

It is possible to open a Freedom24 account with USD or EUR currency. Within the Personal Area, it will be possible to manually convert the deposited EUR into US dollars (and vice versa).

» Deposits & Withdrawals

Freedom24 users can make deposits and withdraw funds from their accounts by bank transfer or by credit/debit card. There is a 7e fee for each withdrawal as well as a $60 deposit fee for the reversal of securities.

No minimum deposit is required with Freedom24.

Products and Markets

Freedom24 allows clients to invest in more than one million financial instruments, including stocks from Europe and the United States, ETFs and OTC.

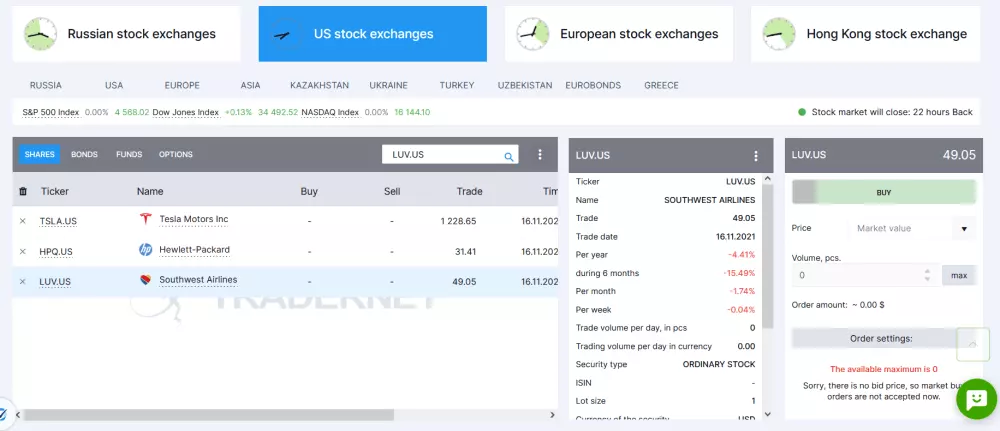

Here is the list of stock markets that you can invest in via the Freedom24 trading platform:

- NYSE

- NASDAQ

- Hong Kong Stock Exchange (HKEX)

- London Stock Exchange

- Deutsche Börse

- Borsa Italiana

- Kazakhstan Stock Exchange (KASE)

Over 1,500 ETFs from issuers such as iShares, Vanguard and BlackRock are available with Freedom24.

Trading Fees and Costs

The commissions applied by Freedom24 have a degressive structure and depend on the type of account chosen by the client:

Smart account in EUR: 0.02€/$ per share, with a minimum fee of 2€/$ per order; SMS notification fee of 0.05€

All inclusive in USD: 0.5% + 0.012€/$ per share, with a minimum fee of 1.20€/$ per order; SMS notification fee of 0€

Additional Fees:

3% on payments made by bank card (provided for each user account)

€7 on every cash withdrawal

The custody of securities, on the other hand, is free.

Freedom24 allows you to use margin (i.e. financial leverage). The annual interest rate applied to the margin used is 18%.

Trading Platform

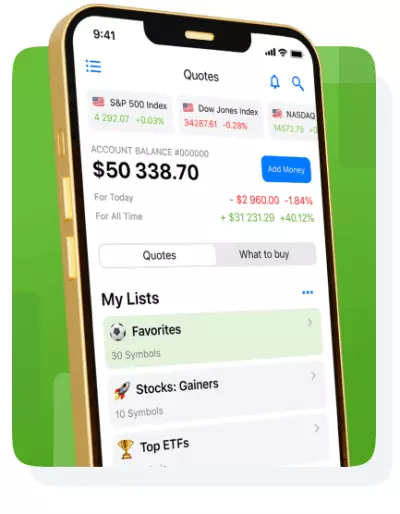

Freedom24 allows you to operate through two proprietary platforms: a web platform and an app available on iOS/Android/Huawei

We tested both platforms - here's what we found and our opinions on both.

To use the Freedom24 trading platform you will not have to download and install any software on your computer. To access the web platform, simply log into the Personal Area from the Freedom24 website.

At this point, you will need to go to the Web Terminal section and you will already be inside the trading platform. The web platform that you will find yourself in front of appears immediately with a clean and easy-to-use interface.

In the upper section you find the available markets (American, European, Russian and Hong Kong).

The search can also be done through the search bar, through which you can find a product by entering its name, ticker or ISIN.

On the right side we find the interface for entering orders.

You can choose between a daily and a continuous order. The available order types are:

- Market Order

- Limit Order

- Stop Order

During this step you can also indicate the intention to use the margin, or a loan from the broker to execute the operation.

The offer of charts for each financial instrument on the platform is interesting.

In fact, on the dedicated page you can customize each chart, adding a multitude of indicators and/or geometric tools, thus having the ability to conduct a technical analysis of stocks.

Promotions

The WELCOME promotion, aimed at new clients who have opened a Freedom24 account, is active until 28 February 2025.

How does it work? By opening a new account, based on the deposited amount, you will receive a variable number of free shares, each worth between $3 and $800.

Here is how the promotion works:

- With a first deposit between 5,000€ and 19,999€ you receive 3 free shares, using the promotional code WELCOME5

- With a first deposit between 20,000€ and 49,999€ you receive 10 free shares, using the promotional codes WELCOME5 and WELCOME20

- With a first deposit over 50,000€ you receive 20 free shares, using the promotional codes WELCOME5, WELCOME20 and WELCOME50

For more details on how to take advantage of the bonus, see the promotion's dedicated page.

Customer Support

Freedom24 clients have several channels available to get in touch with the broker's customer service, which we list below:

- Live chat on the website

- Speak with an operator via WhatsApp, Viber, Telegram, Instagram and Facebook

- Telephone: +49 30 863 21 84 0 for German customers and +357 25 25 77 85 for international customers

- Email:

This email address is being protected from spambots. You need JavaScript enabled to view it. for European customers - FAQ section with general questions and answers

Extremely interesting is the Freedom24 training centre made available to users, where it is possible to find investment ideas by asset, sector, and market momentum. Each investment card will present valuable information that will help the user get an in-depth picture of the financial instrument, such as the potential return, risk level, target price, etc.

In this regard, Freedom24 received a certificate of merit from Bloomberg for advice on Beyond Meat and Zoom Video shares, ranked by the popular financial newspaper at the top of the Bloomberg rating for the accuracy of the forecast.

Overall Rating

Within this review, we discovered the options of Freedom24, a new broker in the online trading landscape with great potential.

Also interesting is the offer of the D-account Securities Swap and the Long-Term Funds Placement Securities Swap, an investment solution that offers returns in EUR or USD at an annual rate of up to 7.16%. This can be a good choice for those who do not want to take risks with investments but are satisfied with a lower but less risky return.

Freedom24 allows you to trade stocks, ETFs, bonds, futures and options. However, some tools, such as CFDs, are missing.

The markets to which you can have access are different: from Europe to the USA to Asia.

The platform through which to operate is decidedly user-friendly and intuitive. Due to its characteristics, it can suit both novice investors and those with experience in online trading.

Overall, therefore, our views on Freedom24 are positive. Although relatively new, this broker passes our tests with flying colours on safety, transparency and quality of the services offered.

We expect that over time, it will be able to extend its offer to make it even more advanced and complete.

*Investments in securities and other financial instruments always involve the risk of loss of capital. Past performance does not guarantee future returns.